How to Get an FSA HSA Letter of Medical Necessity in Phoenixville: Step-by-Step Guide

Managing healthcare expenses can be overwhelming but flexible spending accounts (FSAs) and health savings accounts (HSAs) make it a bit easier. If you’re in Phoenixville and want to maximize your benefits you might’ve heard about the importance of a letter of medical necessity. This simple document can unlock coverage for treatments or products that aren’t always included under standard plans.

I know how confusing the process can seem at first. Understanding when and why you need a letter of medical necessity can help you save money and avoid headaches. Let’s break down what this letter means for your FSA or HSA and how to get one in Phoenixville.

Understanding FSA and HSA Accounts

Flexible spending accounts (FSAs) and health savings accounts (HSAs) offer tax-advantaged ways to manage eligible healthcare expenses in Phoenixville. I use these accounts to optimize my spending and reduce my taxable income when covering out-of-pocket costs.

Key Differences Between FSA and HSA

Ownership distinguishes FSA and HSA accounts. An employer owns the FSA, while the individual owns the HSA. Contribution rules differ—2024 FSA contributions cap at $3,200, but only $610 carries over; HSA contributions cap at $4,150 for individuals and $8,300 for families, with unused funds rolling over annually (IRS). Eligibility varies—anyone with employer benefits can open an FSA, while only those with a high-deductible health plan can open an HSA. Investment options exist only for HSAs, allowing account holders to invest unused balances.

Benefits of Using FSA and HSA in Phoenixville

Tax savings remain the main reason I use FSA and HSA accounts—contributions and qualified withdrawals don’t count as taxable income. Immediate access to annual FSA funds provides payment flexibility at the start of the plan year, which is useful for upfront costs such as deductibles and copays. HSAs offer additional features, including investment growth and portability, which benefit residents who may change employers in Phoenixville. Widespread local healthcare providers accept FSA and HSA payments, enabling efficient use on eligible medical, dental, and vision expenses.

What Is a Letter of Medical Necessity?

A letter of medical necessity serves as documentation from a licensed healthcare provider confirming that a treatment, product, or service is essential for diagnosing, treating, or preventing a specific medical condition. I use this letter to validate expenses not routinely covered by standard health insurance, FSAs, or HSAs in Phoenixville.

Purpose of the Letter

The purpose of a letter of medical necessity is to establish medical justification for a recommended service, item, or therapy. I provide this letter to my FSA or HSA administrator when an expense falls outside standard eligibility lists. Insurers and account administrators in Phoenixville require it to determine if expenditures, such as physical therapy, prescription orthotics, or certain nutritional supplements, meet IRS criteria for approved reimbursement.

Common Scenarios Requiring a Letter

I typically see a letter of medical necessity requested for:

- Specialty therapies: Physical therapy, occupational therapy, or speech therapy when not routinely covered by basic plans.

- Durable medical equipment: Wheelchairs, CPAP machines, and orthotics often need documentation showing medical requirement.

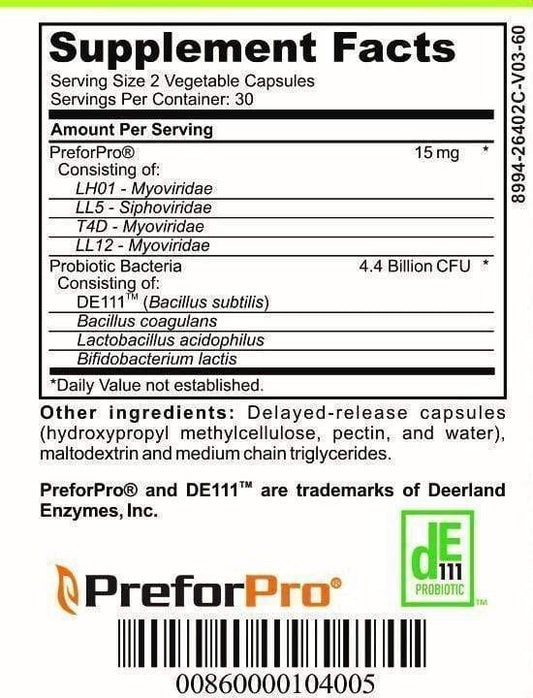

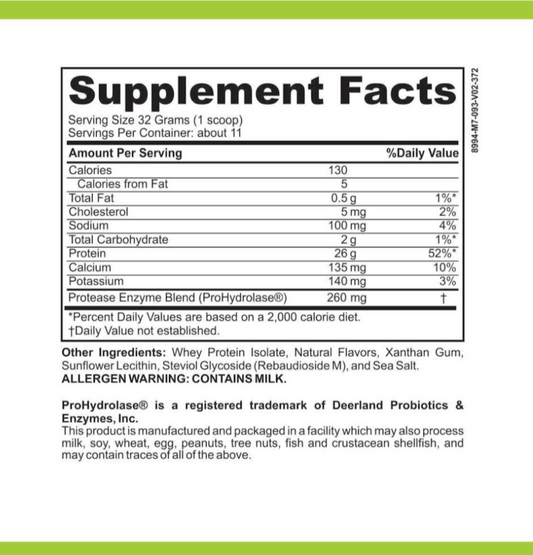

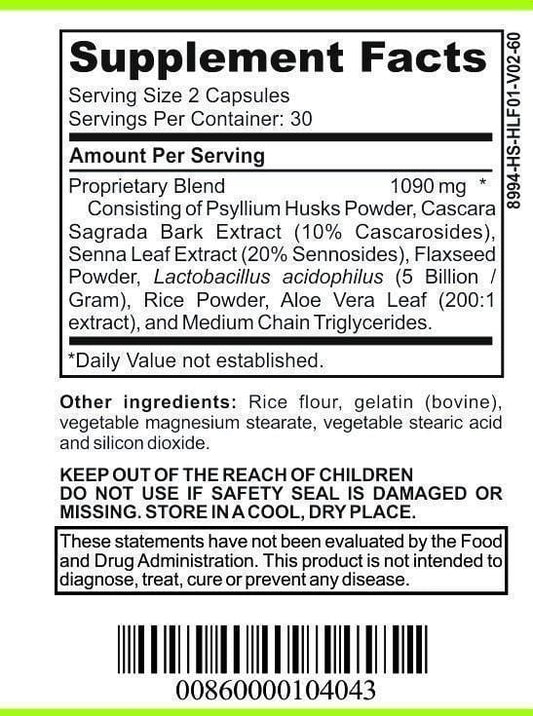

- Nutritional and dietary needs: Physician-prescribed supplements or foods for diagnosed conditions, such as metabolic disorders.

- Mental health treatments: Counseling or behavioral therapies exceeding standard session limits.

Plan administrators or insurers in Phoenixville may not consider these expenses eligible for FSA or HSA reimbursement unless the letter details why the service or product addresses a diagnosed medical issue.

Obtaining an FSA HSA Letter of Medical Necessity in Phoenixville

Obtaining an FSA or HSA letter of medical necessity in Phoenixville involves collaboration with a qualified local healthcare provider. I secure this required documentation before submitting reimbursement claims for treatments or items not automatically approved.

Who Can Write the Letter?

A licensed healthcare provider issues a letter of medical necessity in Phoenixville. Physicians, nurse practitioners, psychologists, and dentists in Phoenixville all qualify if they're directly involved in my diagnosis or ongoing care. Providers include primary care doctors for chronic condition management, specialists for outpatient procedures, and pediatricians for child-specific therapies.

Steps to Request the Letter

I follow a straightforward process to request a letter of medical necessity for FSA or HSA use in Phoenixville:

- Contact my healthcare provider: I schedule an appointment or contact my provider's office about the need for supporting FSA or HSA documentation.

- Provide medical details: I supply details about my medical condition, recommended treatment, or product and describe why standard insurance or account eligibility doesn't apply.

- Formal request submission: I ask my provider to draft a letter including my diagnosis, prescribed service or product, medical necessity explanation, provider credentials, and signature.

- Review and retention: I check that all IRS and plan requirements appear in the letter before sending it to my FSA or HSA administrator for approval and recordkeeping.

- File with reimbursement claim: I attach the letter when submitting reimbursement claims related to the specified expense.

Phoenixville residents often complete these steps through local provider offices familiar with FSA and HSA documentation. I maintain copies for tax and audit purposes as local employers and administrators can request verification.

Important Considerations for Phoenixville Residents

Phoenixville residents using FSAs or HSAs rely on specific rules for medical necessity letters. Accurate documentation and adherence to guidelines make local reimbursement simpler.

Accepted Medical Expenses

Eligible FSA and HSA expenses in Phoenixville extend beyond common copays and prescriptions. Qualifying examples include:

- Medical: CPAP machines, orthopedic braces, fertility treatments

- Dental: Orthodontia, surgical tooth extractions, custom mouthguards

- Vision: Prescription eyeglasses, LASIK surgery, specialty contact lenses

- Mental Health: Therapy sessions, counseling, psychiatric care

- Other: Medical nutrition therapy, adaptive equipment for physical disabilities

A valid letter of medical necessity supports reimbursement for items not on standard eligibility lists. Examples include specialized formulas for chronic conditions, alternative therapies like acupuncture, or durable devices required for daily functioning.

Documentation and Submission Tips

Accurate, complete documentation ensures approval from FSA or HSA administrators in Phoenixville. I gather the following before submission:

- Provider Information: Full name, credentials, state license number, and signature of the local healthcare provider

- Detailed Rationale: Clear explanation of the medical condition, why standard treatments fall short, how the recommended treatment addresses the need

- Service Dates: Dates or length of time the product or service remains medically necessary

- Itemization: Specific description of products, treatments, or services requiring coverage

Electronic submission options appear common among Phoenixville employers and FSA/HSA providers. When I submit a PDF or scanned copy, I confirm legibility and include all supporting documents, such as treatment plans or physician notes. Retaining copies aligns with IRS audit guidance and local policy, reducing risks of claim denials.

Conclusion

Navigating FSA and HSA requirements in Phoenixville doesn't have to be overwhelming when you have the right information and support. I always recommend reaching out to your healthcare provider early if you think you'll need a letter of medical necessity for your expenses.

Having this documentation ready can make a real difference in how smoothly your claims are processed and how much you save on out-of-pocket costs. With the right approach you'll get the most out of your FSA or HSA benefits and keep your healthcare finances on track.