How to Get an FSA HSA Letter of Medical Necessity in Maple Glen: Requirements & Tips

Managing healthcare expenses can get tricky especially when I want to make the most of my Flexible Spending Account (FSA) or Health Savings Account (HSA). If I’m in Maple Glen and need to use these accounts for certain treatments or products I’ll often hear about something called a Letter of Medical Necessity. This document can make all the difference when it comes to getting my expenses approved.

I know how confusing it can be to figure out what qualifies and how to get the right paperwork in place. That’s why understanding the role of a Letter of Medical Necessity is key for anyone using an FSA or HSA in Maple Glen. Let me break down what I’ve learned so you can feel confident about your next steps.

Understanding FSA and HSA Accounts

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) offer tax-advantaged ways to pay for eligible medical expenses in Maple Glen. Both account types let me set aside pre-tax dollars for services, prescriptions, and medical supplies. I can use funds for out-of-pocket costs such as copays, deductibles, and certain over-the-counter items.

FSAs typically link to employer-based health insurance plans and require annual contributions, with unused funds usually forfeited at year-end. HSAs connect to high-deductible health plans (HDHPs), allowing contributions to carry over each year and earnings to grow tax-free.

Direct connections between my FSA or HSA provider and approved healthcare merchants simplify claims. Approved expenses must meet IRS criteria, with requirements published in IRS Publication 502. Some healthcare products and services in Maple Glen need extra documentation, including a Letter of Medical Necessity, to get reimbursement. I reference account-specific portals or administrators for claim submissions and policy details.

What Is a Letter of Medical Necessity?

A Letter of Medical Necessity (LMN) documents the need for specific healthcare services or products when using FSA or HSA funds. In Maple Glen, I use this letter to show that an expense isn't solely for general health but directly treats a diagnosed medical condition.

Purpose and Importance

A Letter of Medical Necessity supports FSA or HSA claims for items not automatically eligible, per IRS guidelines. Examples include massage therapy, supplements, or specialty equipment. I present this letter to ensure reimbursement for treatments that my doctor recommends for specific diagnoses. I rely on an LMN when the FSA or HSA administrator asks for proof that the expense aligns with my medical condition and isn't for personal benefit.

Typical Contents of the Letter

A Letter of Medical Necessity typically includes these details:

- Patient identification (name, date of birth, address in Maple Glen)

- Diagnosed medical condition (e.g., chronic back pain, diabetes)

- Specific recommendation (name of service or product, such as orthotics or occupational therapy)

- Duration of treatment (e.g., six months, ongoing)

- Physician’s contact information and signature

My healthcare provider drafts this letter on official letterhead to confirm that the described product or service directly manages my medical diagnosis and meets IRS substantiation requirements for tax-free reimbursement from my FSA or HSA.

Requirements for a Valid FSA HSA Letter of Medical Necessity in Maple Glen

A valid FSA HSA Letter of Medical Necessity in Maple Glen must meet strict IRS and plan administrator guidelines. Specific criteria around who issues the letter and how it's documented impact reimbursement eligibility for specialized medical expenses.

Who Can Write the Letter?

Licensed healthcare providers in Maple Glen must write the FSA HSA Letter of Medical Necessity. Physicians, nurse practitioners, psychologists, and dentists—examples of recognized providers—can issue this documentation as long as they're authorized in Pennsylvania. Administrative staff or unlicensed assistants cannot sign on the provider's behalf.

Specific Documentation Needed

Valid letters include several required details for FSA HSA approval in Maple Glen:

- Patient name and date of birth, matching account records

- Specific diagnosis, described with ICD-10 codes when possible

- Clearly defined medical necessity for each recommended service or product

- Duration of medical need, including start and end dates

- Provider’s printed name, signature, address, and NPI number

- Date of issue, typically within the current plan year

Incomplete or outdated forms, or ones lacking these elements, risk denial from FSA or HSA administrators. Clear and complete documentation ensures eligible expense reimbursement.

How to Obtain a Letter of Medical Necessity in Maple Glen

Getting a Letter of Medical Necessity in Maple Glen starts with your healthcare provider. I follow a structured process to help ensure eligibility and streamline reimbursement for FSA or HSA expenses.

Steps to Request the Letter

- Schedule an Appointment

I contact my licensed healthcare provider in Maple Glen, such as a physician or nurse practitioner, to discuss the medical condition requiring specific products or services for FSA or HSA use.

- Document Medical Need

I bring relevant medical records or notes to my appointment to support my case for medical necessity, ensuring documentation aligns with IRS substantiation rules.

- Request Detailed Documentation

I ask the provider to complete and sign the letter on their official letterhead, including my name, date of birth, specific diagnosis with ICD-10 codes, a clear explanation of why the product or service is medically necessary, recommended treatment duration, and the provider’s details plus NPI number.

- Confirm Format and Completeness

I review the completed letter, checking all sections for completeness to prevent administrative delays with FSA or HSA administrators.

Tips for a Smooth Approval Process

- Verify Provider Credentials

I confirm that my provider is licensed in Pennsylvania and authorized to supply the documentation.

- Request IRS-Compliant Language

I ensure the letter uses specific language indicating the treatment, service, or product is required to treat my diagnosed medical condition, not general health.

- Submit Early

I submit the LMN to my plan administrator as soon as possible, providing extra time if there's a request for additional information.

- Keep Copies

I always maintain copies of the LMN and related paperwork, making it easier to re-submit or appeal if my claim encounters issues.

- Review Plan Requirements

I consult my FSA or HSA administrator’s list of required documentation for Maple Glen residents before submission to avoid errors.

By following these steps and tips in Maple Glen, I support my FSA or HSA reimbursement and reduce the risk of denial for eligible medical expenses.

Common Expenses Covered by a Letter of Medical Necessity

Various expenses qualify for FSA or HSA reimbursement in Maple Glen with a valid Letter of Medical Necessity. I list frequent examples here for clarity:

- Specialized therapies: Physical therapy, occupational therapy, and speech therapy qualify when prescribed for conditions such as post-surgical recovery or developmental disorders.

- Alternative treatments: Acupuncture, chiropractic care, and massage therapy qualify if a Maple Glen provider documents their role in treating a diagnosed medical condition.

- Medical devices: Durable medical equipment such as CPAP machines for sleep apnea, breast pumps, orthopedic braces, and insulin pumps receive approval when medical need is established by a licensed practitioner.

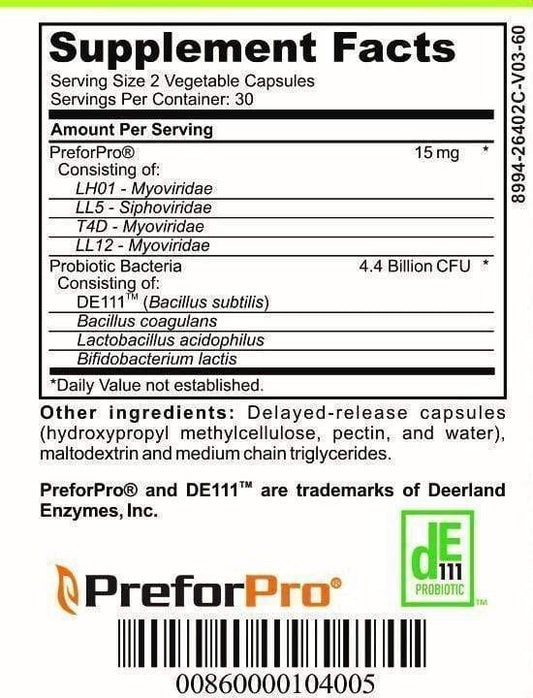

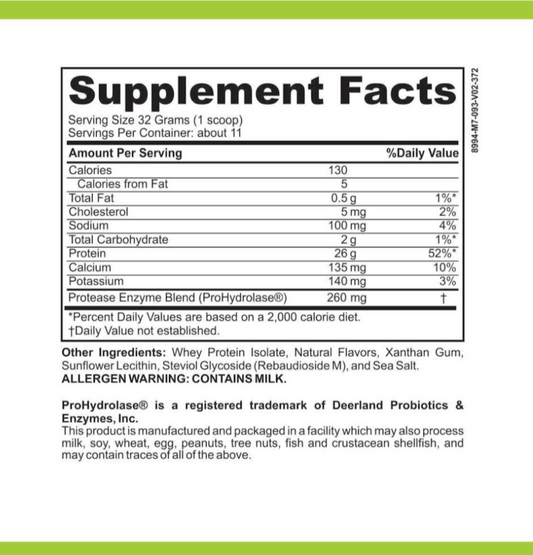

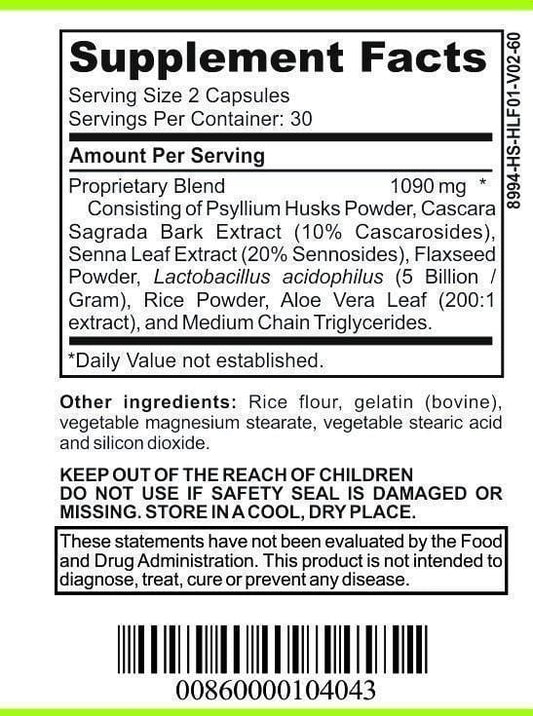

- Nutritional products: Prescribed supplements, nutrition shakes, and allergen-free foods qualify if they're necessary for the management of specific conditions like metabolic disorders or severe allergies.

- Mental health interventions: Cognitive behavioral therapy, counseling, and behavioral therapy receive FSA or HSA coverage in Maple Glen when an LMN demonstrates their necessity for a documented mental health diagnosis.

- Weight-loss programs: Medically supervised weight-loss programs get approval when provider documentation shows they're essential for managing obesity-related illnesses such as diabetes or hypertension.

- Vision and dental treatments: Orthodontia, prescription glasses, and advanced dental care qualify if a provider establishes that services address a medical problem rather than routine care.

| Expense Category | Examples | LMN Requirement |

|---|---|---|

| Specialized therapies | Physical, occupational, speech therapy | Yes |

| Alternative treatments | Acupuncture, chiropractic, clinical massage | Yes |

| Medical devices | CPAP machines, orthotics, breast pumps | Yes |

| Nutritional products | Metabolic formula, prescription supplements, allergen-free foods | Yes |

| Mental health interventions | Counseling, cognitive behavioral therapy, behavioral modification | Yes |

| Weight-loss programs | Medically supervised weight-loss services | Yes |

| Vision and dental treatments | Orthodontic procedures, prescription eyeglasses, advanced dental restoration | Yes |

IRS Publication 502 and most FSA HSA administrators in Maple Glen require a physician’s explicit documentation for all these categories. My submission of a detailed LMN citing specific medical conditions and recommended interventions supports an eligible claim for these expenses.

Mistakes to Avoid When Submitting Your FSA HSA Letter

Incorrect provider credentials often cause denial. I always ensure the signing provider holds a valid Pennsylvania license and that their title, address, and NPI number appear on the letter.

Incomplete documentation frequently results in rejection. I include the patient’s name, diagnosis with ICD-10 code, recommended service or product, its medical necessity, the treatment duration, and all provider identifiers.

Outdated or expired letters aren't accepted by plan administrators. I confirm the letter reflects recent evaluations and matches my plan’s timeline for acceptance.

Vague medical rationale weakens a claim. I use explicit language, citing how the recommended intervention treats a specific, diagnosed condition rather than mentioning general wellness.

Missing supporting documents, like test results or provider notes, can delay processing. I attach these records to substantiate my LMN whenever possible.

Improper formatting leads to administrative holds. I use my provider’s official letterhead and keep the structure consistent with IRS and plan requirements, avoiding handwritten or informal submissions.

Lack of communication with my plan administrator often results in overlooked requirements. I check my plan’s current forms, submission instructions, and appeal procedures before sending documentation.

Duplicate submissions or failing to retain copies can disrupt reimbursement. I keep digital and paper records of every LMN and all correspondence with my FSA or HSA plan for at least 3 years.

Conclusion

Getting FSA or HSA expenses approved in Maple Glen can feel overwhelming but knowing how to secure a strong Letter of Medical Necessity makes a real difference. I always make sure my paperwork is thorough and up to date so I can avoid unnecessary delays or denials.

If you’re working through this process yourself don’t hesitate to ask your provider for help or double-check your plan’s requirements. Staying organized and proactive can help you make the most of your FSA or HSA benefits while minimizing stress.