How to Get an FSA HSA Letter of Medical Necessity in Lansdale: Step-by-Step Guide

Managing health expenses can get confusing especially when it comes to using FSA or HSA funds for certain treatments or products. I know how important it is to make every dollar count and avoid surprise denials. That’s where a Letter of Medical Necessity comes in—it’s often the key to unlocking those benefits for items your doctor recommends but your plan doesn’t automatically cover.

If you’re in Lansdale and wondering how this process works or what you’ll need from your healthcare provider you’re not alone. I’ve navigated these requirements myself and learned just how valuable the right documentation can be. Let’s clear up what a Letter of Medical Necessity is and why it matters for your FSA or HSA claims.

Understanding FSA and HSA Accounts

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) let me pay for eligible health expenses with pre-tax dollars. An FSA usually comes through an employer as part of a benefits package, while I can set up an HSA if I have a high-deductible health plan. These accounts both cover qualified medical, dental, and vision costs like copays, prescriptions, and medical supplies.

Annual limits exist for contributions. In 2024, I can contribute up to $3,200 to an FSA and $4,150 to an HSA if I'm single, according to IRS guidelines. HSAs allow unused funds to roll over indefinitely, but FSAs usually only carry over a limited amount, with some plans allowing up to $610.

Eligible Lansdale residents often use these accounts to manage out-of-pocket costs that insurance won't always cover. Both account types may require specific documentation, such as receipts or letters of medical necessity, for reimbursement of certain items or therapies, especially those not automatically considered eligible by the IRS. I keep careful records and review eligibility rules each year to maximize my account benefits.

What Is a Letter of Medical Necessity?

A Letter of Medical Necessity documents that a specific treatment, service, or product is essential for a diagnosed medical condition. My healthcare provider prepares this letter to justify why an item qualifies for FSA HSA reimbursement. The document states the diagnosis, describes why standard treatments aren't enough, and details how the recommended item addresses my medical needs. Insurance providers and plan administrators in Lansdale reference this letter to determine eligibility for coverage under FSA or HSA plans. Typical examples include documentation for therapies, specialty equipment, and certain over-the-counter products like orthopedic supports or allergy devices. Accurate completion and submission of the letter connect my qualified medical expenses with proper FSA HSA usage.

Why You Need a Letter of Medical Necessity in Lansdale

Using an FSA or HSA for specific treatments or health-related items in Lansdale needs more than just a receipt. I document a medical practitioner's recommendation with a Letter of Medical Necessity to show the expense meets IRS requirements for reimbursement.

Eligible Expenses That Require a Letter

Certain medical goods and services need additional documentation for FSA or HSA claims. I submit a letter for expenses like:

- Therapy sessions: Examples include physical therapy and occupational therapy, especially if prescribed for injury rehabilitation.

- Medical equipment: Examples include CPAP machines, orthopedic shoes, or mobility aids.

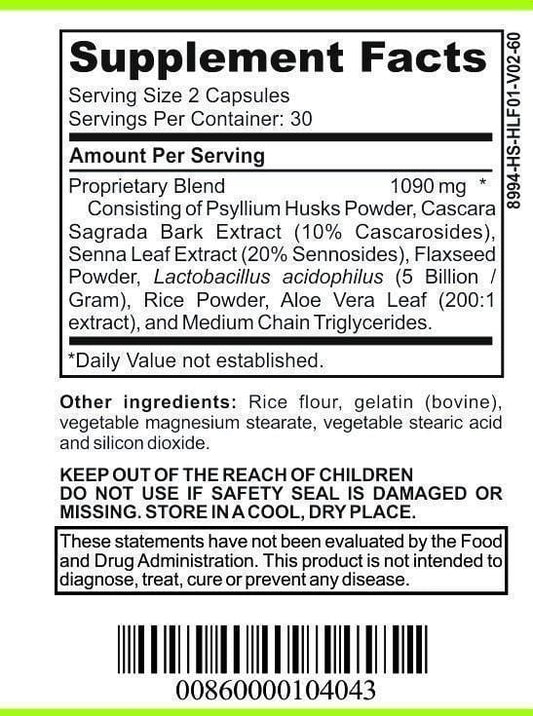

- Over-the-counter items: Examples include allergy medications, sunscreen, or hot/cold packs when they're not considered "primarily for general health."

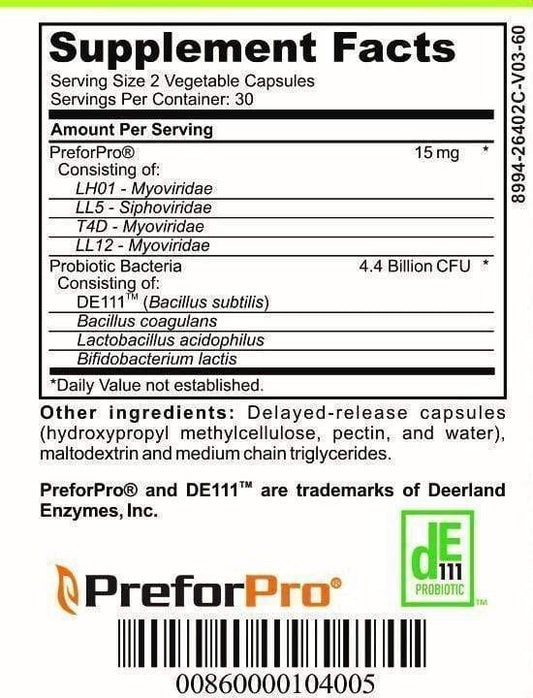

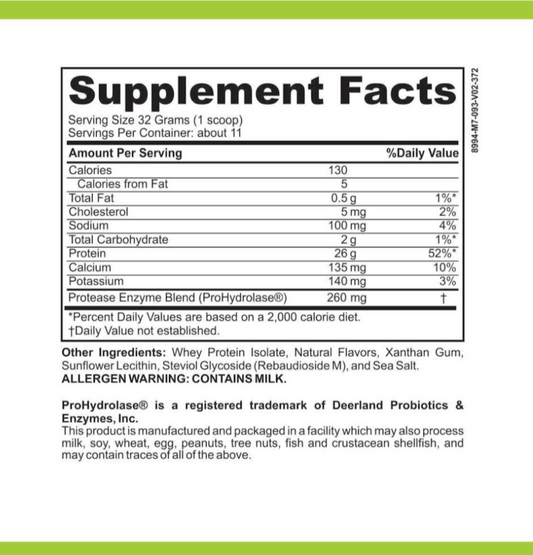

- Nutritional supplements: Examples include prescribed vitamins or special dietary foods linked directly to a diagnosed condition.

- Specialized treatments: Examples include chiropractic care, acupuncture, or counseling that's medically required.

I find that Lansdale clinics and pharmacies often clarify the IRS criteria to help patients attach proper justification to these purchases.

Common Providers and Services in Lansdale

Healthcare professionals and service centers in Lansdale handle these documentation needs regularly. I frequently work with:

- Primary care physicians: Examples include patient exams resulting in recommendations for medical products.

- Specialty practitioners: Examples include orthopedists providing documentation for custom orthotics.

- Physical therapists and chiropractors: Examples include evaluation reports tied to necessary equipment.

- Local pharmacies: Examples include pharmacists validating prescription-only product eligibility.

- Pediatricians and allergy specialists: Examples include letters for pediatric therapy or allergy devices.

Connecting with these Lansdale-based providers streamlines getting the required Letter of Medical Necessity for FSA and HSA claims.

How to Obtain an FSA HSA Letter of Medical Necessity in Lansdale

Obtaining a Letter of Medical Necessity in Lansdale involves contacting a healthcare provider and supplying detailed information about the medical requirement. I find that the process connects qualified medical expenses to FSA or HSA reimbursement when insurance doesn't cover certain services or products.

Steps to Request the Letter from Your Healthcare Provider

- Schedule an Appointment: I contact my healthcare provider in Lansdale, such as a primary care physician, specialist, or physical therapist, to discuss my need for the required product or service.

- Explain Medical Needs: I clearly present my diagnosis and describe why the treatment, device, or product is essential for managing my condition.

- Request Documentation: I ask my provider to prepare a signed Letter of Medical Necessity tailored for my FSA or HSA plan administrator, specifying the IRS requirements for documentation.

- Review and Submit: I review the letter for completeness and accuracy before submitting it to my FSA or HSA administrator for approval.

What Information Should Be Included

- Patient’s Information: The letter includes my full name, date of birth, and relevant identifiers to link the request directly to me.

- Specific Diagnosis: My provider states the precise medical diagnosis justifying the medical need, for example, asthma, chronic back pain, or allergies.

- Treatment Justification: The document details why standard treatments are inadequate, citing medical facts or treatment failures.

- Recommended Service or Product: My provider lists the exact service, therapy, or product that’s medically necessary, with examples like allergy testing, orthopedic supports, or nutritional supplements.

- Duration/Frequency of Need: The provider specifies how long the product or service is needed, such as “ongoing” or “for 12 months.”

- Provider’s Credentials and Signature: The letter contains my provider’s printed name, license number or NPI, office address in Lansdale, contact details, and physical signature to ensure validity for FSA or HSA reimbursement.

Tips for a Successful Submission

Submitting an FSA or HSA Letter of Medical Necessity in Lansdale calls for careful preparation. I follow specific strategies to help my claims process smoothly and meet IRS eligibility standards.

Avoiding Common Mistakes

I check that every required detail is present. Missing provider credentials, incomplete diagnosis information, or generic descriptions lead to denials in FSA HSA submissions. I use the provider’s official letterhead and confirm the document's date matches my appointment to prevent discrepancies. For every Lansdale provider, I confirm signatures, National Provider Identifier (NPI) numbers, and clear rationale for the prescribed product or service.

Maximizing Reimbursement Potential

I gather supporting documentation, like prescriptions or specialist notes, before submission. Clearly connecting the letter’s wording to my diagnosis and the IRS list of eligible expenses increases approval rates. When claiming specialized treatments—such as durable medical equipment or non-routine therapies in Lansdale—I provide receipts and documentation together. I keep personal copies of all documents and submit through the approved FSA HSA portal for tracking. I reference specific IRS guidelines to link each expense to my eligible medical necessity.

Conclusion

Navigating FSA and HSA reimbursement for specialized medical expenses in Lansdale can feel overwhelming but having a well-prepared Letter of Medical Necessity makes a huge difference. I’ve found that working closely with local healthcare providers and double-checking every detail in my documentation helps avoid unnecessary delays and denials.

If you’re planning to use your FSA or HSA for treatments or products that require extra justification don’t hesitate to ask questions and stay organized. With the right approach you can maximize your benefits and ensure your health needs are fully supported.