How to Get an FSA HSA Letter of Medical Necessity in Hatboro for Maximum Reimbursement

Managing healthcare expenses can get confusing especially when it comes to using Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA). I’ve found that one of the most common hurdles is understanding when you need a Letter of Medical Necessity—especially if you’re in Hatboro and want to make sure your purchases qualify.

If you’re trying to use your FSA or HSA for certain treatments or products your provider might require this special letter. I know how important it is to get the details right so you don’t miss out on valuable savings. Let’s break down what a Letter of Medical Necessity means for Hatboro residents and how you can make the most of your benefits.

Understanding FSA and HSA Accounts

FSA and HSA accounts let me pay for certain medical expenses with pre-tax dollars. Each account type offers unique features and rules, affecting how I use them for health-related purchases in Hatboro.

Key Differences Between FSA and HSA

FSA accounts connect to my employer’s benefits plan, letting me contribute up to $3,050 in 2024 (IRS, 2024). HSA accounts link to a qualified high-deductible health plan, letting me contribute up to $4,150 individually or $8,300 for families in 2024 (IRS, 2024).

- Ownership: I lose unspent FSA funds at year-end unless my plan offers a grace period or limited carryover, while I own my HSA account independently and funds roll over every year.

- Portability: FSA funds stay with my employer, but HSA funds stay with me if I switch jobs or retire.

- Usage: HSA funds cover current or future qualified expenses, while FSA funds typically cover eligible expenses within the plan year.

Eligible Expenses and Requirements

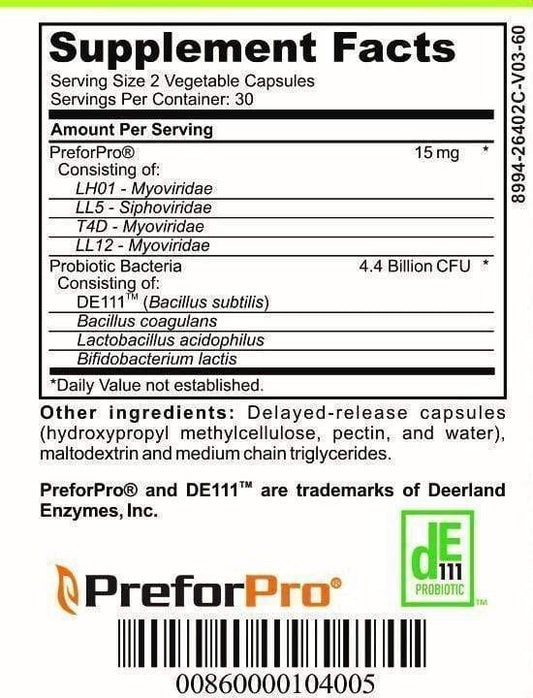

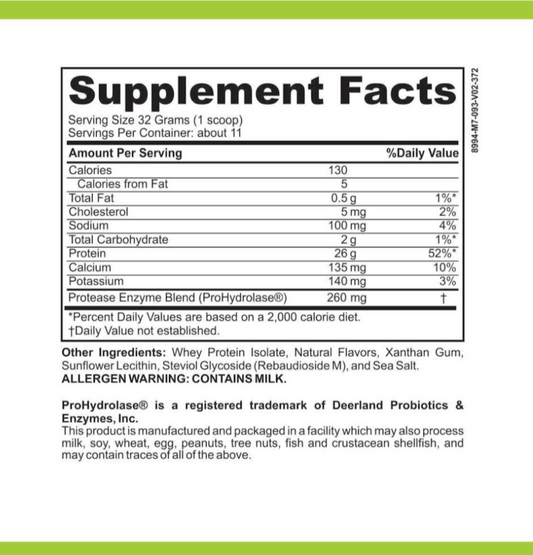

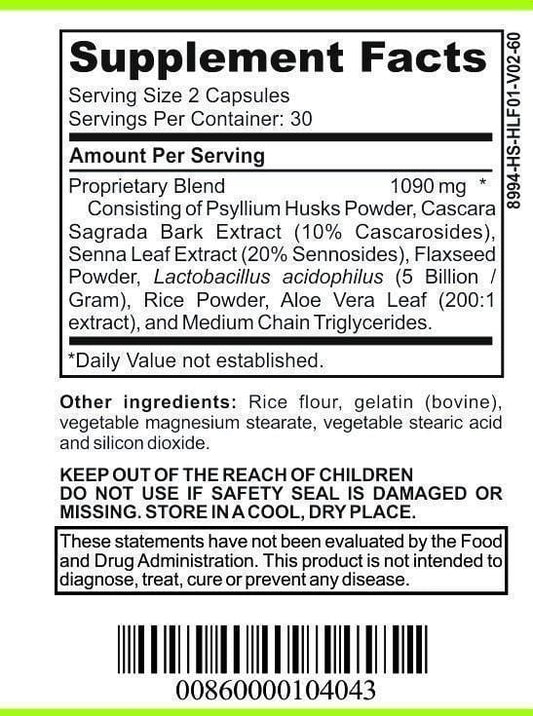

Both accounts pay for qualified medical expenses set by IRS Publication 502, like prescription drugs or doctor co-pays. Some items, such as certain over-the-counter drugs or medical devices, require a Letter of Medical Necessity signed by my healthcare provider if the IRS classifies them as potentially non-essential.

- Medical supplies: Items like CPAP machines or orthopedic shoes may need a letter for reimbursement.

- Therapies: Treatments including chiropractic visits or physical therapy sometimes require documentation.

- Specialty services: Programs for smoking cessation or weight loss tied to a specific diagnosis usually require extra proof of medical need.

Proper documentation and provider verification are vital for me to claim FSA or HSA reimbursement in Hatboro.

What Is a Letter of Medical Necessity?

A Letter of Medical Necessity documents a healthcare provider's recommendation for a service, product, or treatment not automatically eligible for FSA or HSA reimbursement. I use this letter to validate purchases for items like specialized therapy, adaptive equipment, or advanced medical devices under IRS requirements.

When Do You Need a Letter?

IRS regulations require a Letter of Medical Necessity when requesting FSA or HSA reimbursement for items or services that aren't on the standard eligibility list. I obtain this letter when claiming costs for medical supplies, alternative therapies, nutritional supplements, or treatments like acupuncture. Hatboro residents often need this documentation for CPAP machines, special orthopedic devices, or ongoing counseling not covered without proof of necessity.

Who Can Write a Letter of Medical Necessity?

Licensed healthcare providers write Letters of Medical Necessity. I request this letter from my primary care physician, specialist, or dentist, depending on the item or service. IRS guidelines specify that only medical professionals actively managing the treatment plan—such as MDs, DOs, and certain therapists—are authorized to issue this documentation for FSA or HSA claims.

Obtaining an FSA HSA Letter of Medical Necessity in Hatboro

Getting an FSA HSA letter of medical necessity in Hatboro streamlines reimbursement for specialized healthcare expenses. Local healthcare professionals recognize Hatboro residents' unique needs and provide supporting documentation for medically necessary products and services.

Local Providers and Services in Hatboro

Many Hatboro clinics, primary care practices, and therapy offices support the FSA HSA letter process. Local providers include family physicians at Hatboro Medical Associates, behavioral therapists at Hatboro Psychology Group, and physical therapists at area rehabilitation centers. Many pharmacies and durable medical equipment suppliers in Hatboro coordinate with healthcare providers to ensure proper documentation.

Steps to Request a Letter in Hatboro

Requesting an FSA HSA letter of medical necessity in Hatboro follows these basic steps:

- Schedule an appointment with a licensed healthcare provider managing your treatment.

- Discuss the specific medical product, service, or therapy requiring FSA HSA reimbursement.

- Provide details, such as brand, duration, or dosage, as needed for item-specific requests.

- Healthcare providers in Hatboro complete and sign the letter, including required diagnosis, recommended intervention, and expected duration.

- Submit the letter, along with the reimbursement claim, to your FSA or HSA administrator, following their specific submission guidelines.

Local Hatboro clinics may offer templates or direct support for submitting letters, allowing my documentation to meet FSA and HSA administrator requirements efficiently.

Best Practices for Using Your FSA or HSA Letter

Using an FSA or HSA Letter of Medical Necessity in Hatboro lets me maximize reimbursement for eligible health expenses. I simplify the process by following best practices when submitting my letter and avoiding common mistakes.

Submitting Your Letter for Reimbursement

Submitting my Letter of Medical Necessity for FSA or HSA reimbursement requires accuracy and complete documentation. I attach the letter—signed and dated by my licensed provider—to the claim form. I include all supporting details like diagnosis, recommended treatment, and duration of medical necessity. I verify that the provider’s credentials and contact details match my claim. When submitting online, I ensure document scans are clear and legible. If submitting by mail, I keep copies for my records. I review my FSA or HSA administrator’s requirements since submission rules and processing times vary, especially for Hatboro-area employers.

Common Mistakes to Avoid

I avoid missing reimbursement by preventing frequent errors seen in Hatboro:

- Submitting incomplete letters, such as those missing diagnosis or provider signature

- Using a template without personalizing details to my condition or plan requirements

- Failing to attach itemized receipts that match items listed in my letter

- Filing after plan deadlines, as FSA plans often have strict year-end or grace period cutoffs

- Ignoring administrator instructions, such as required forms or digital file formats

I confirm every element before submission to increase approval chances for my FSA or HSA claims.

Conclusion

Navigating FSA and HSA requirements in Hatboro can feel overwhelming but taking the right steps with a Letter of Medical Necessity makes a big difference. I always make sure my documentation is thorough and my provider understands exactly what I need for my claim.

With attention to detail and clear communication with local healthcare professionals I’ve found that the process becomes much smoother. Staying organized helps me get the most out of my benefits and keeps my healthcare expenses manageable year after year.