How to Get an FSA HSA Letter of Medical Necessity in Broomall: Step-by-Step Guide

Navigating the world of healthcare expenses can get confusing especially when it comes to using FSA or HSA funds for treatments and products in Broomall. I know just how important it is to make the most of every dollar set aside for medical needs but sometimes the process feels overwhelming.

If you’ve ever been told you need a letter of medical necessity to unlock your FSA or HSA benefits you’re not alone. Many people in Broomall face this hurdle and aren’t sure where to start. I’m here to break down what a letter of medical necessity is why you might need one and how to get it so you can use your health savings the smart way.

Understanding FSA and HSA Accounts

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) let me pay for eligible healthcare expenses using tax-advantaged funds. FSA funds get set aside by my employer and usually expire at the end of each plan year. HSA funds belong to me, roll over annually, and grow tax-free when I use a high-deductible health plan.

I can use FSA or HSA funds for a range of medical costs, like copays, prescriptions, and qualified medical equipment. Some nontraditional expenses, such as certain therapies or specialty products, may qualify if I get a letter of medical necessity from my provider.

My FSA funds require spending within the plan’s deadline, often December 31, with limited grace periods or carryovers. My HSA balance, in contrast, carries forward without deadlines and accrues interest or investment gains, adding to my long-term healthcare planning.

Both account types connect me to significant tax benefits, but the types of purchases and reimbursement processes depend on my individual plan documents and IRS guidelines. Specific rules apply in Broomall, so I always review local plan details before submitting FSA/HSA claims for treatments or products requiring a letter of medical necessity.

What Is a Letter of Medical Necessity?

A letter of medical necessity is a formal document from a licensed healthcare provider in Broomall or another medical jurisdiction that details why a specific product, treatment, or service qualifies as essential for a patient’s diagnosis or condition. I use this letter when submitting claims for items or services that an FSA or HSA plan doesn’t automatically classify as eligible.

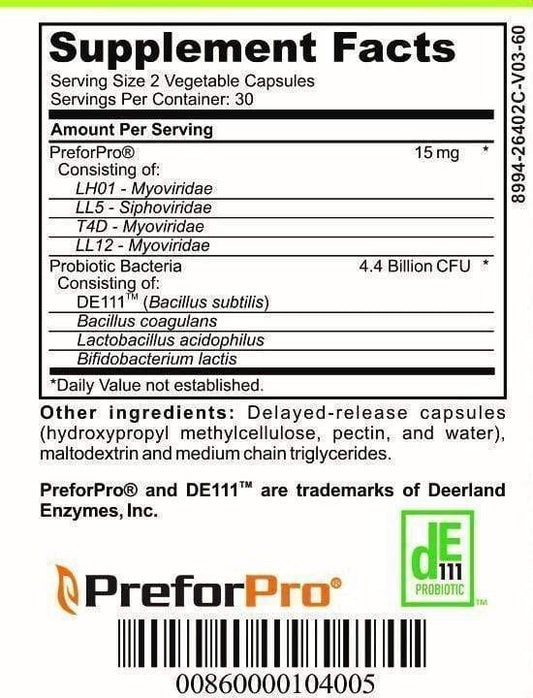

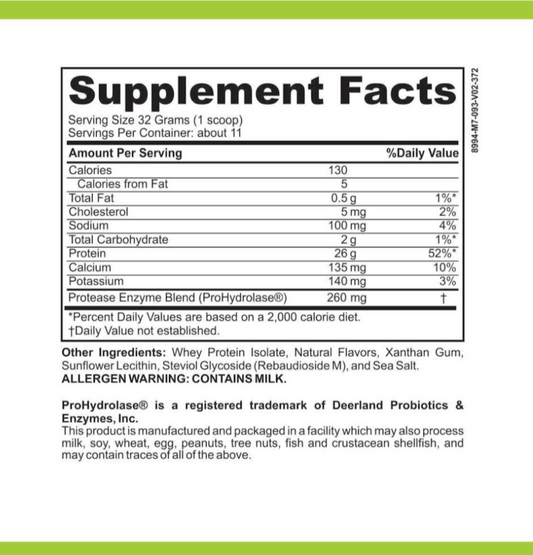

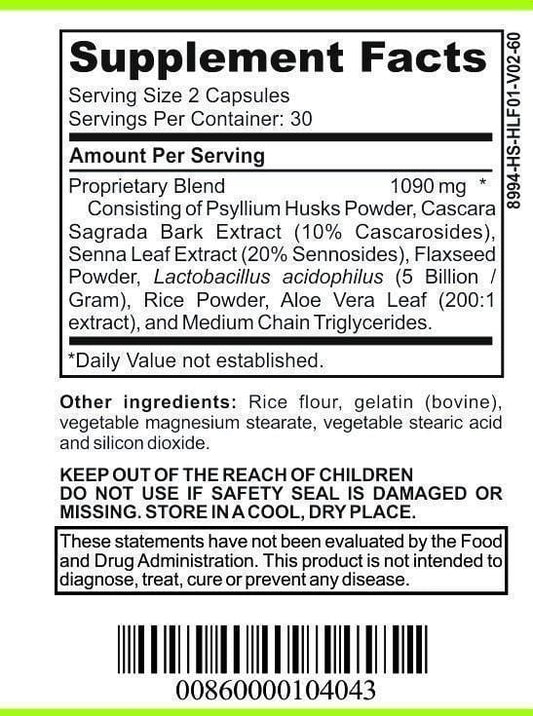

Physicians in Broomall include specific medical justifications, such as the patient’s diagnosis and the treatment’s relevance to health outcomes. FSAs or HSAs often request this letter for expenses like therapeutic massage, nutritional supplements, or certain medical devices. My healthcare provider addresses it to the benefits administrator or insurance company, directly connecting the expense to the patient’s condition.

Most administrators require the letter to list the patient’s name, provider’s credentials, diagnosis, description of the treatment or service, and duration of the medical necessity. I see requests for this letter when submitting claims for items outside standard eligibility lists, especially under IRS Code Section 213(d) guidelines.

When Do You Need a Letter of Medical Necessity in Broomall?

Specific FSA or HSA expenses often need supporting documentation for approval in Broomall. I use a letter of medical necessity when claiming items or services that aren't universally recognized as eligible by the IRS or my plan administrator.

Eligible Expenses Requiring Documentation

FSA and HSA plans often request letters of medical necessity for nonstandard expenses. Examples include physical therapy, specialized medical equipment, massage therapy, orthotic devices, weight loss programs for diagnosed conditions, and adaptive devices for disabilities. I submit such a letter whenever my expense doesn't appear on my plan's automatically covered list, as required by IRS Publication 502 and employer policies.

Common Scenarios for Broomall Residents

Broomall residents often encounter letter requirements for expenses like acupuncture when prescribed for pain management, dental treatments beyond routine care, or over-the-counter medications requiring provider approval. I submit a letter for developmental therapies for children with learning disabilities or nutritional counseling for chronic illnesses, as these cases fall under the "medical necessity" category, not routine wellness or cosmetic use.

How to Obtain a Letter of Medical Necessity in Broomall

Requesting a letter of medical necessity in Broomall follows a direct process. I work with my healthcare provider to document and justify specific treatments or products for FSA or HSA reimbursement.

Working With Local Healthcare Providers

I contact my primary care physician or specialist in Broomall to discuss my medical need. Providers familiar with FSA HSA requirements use my exact diagnosis and prescribed treatment when writing the letter. I confirm their understanding of insurer documentation standards before requesting the letter. Providers in Broomall often add supporting clinical notes to strengthen my claim.

Essential Components of the Letter

I ensure my letter includes these required elements for Broomall FSA HSA claims:

- Patient details with my legal name and date of birth

- Provider identification including credentials, practice address, and National Provider Identifier (NPI)

- Diagnosis code with medical justification for the product or service

- Detailed treatment description specifying frequency, duration, and expected outcomes

- Signature and date from my licensed healthcare provider

I verify completeness, since missing details cause delays or denials from third-party administrators. This careful approach streamlines FSA or HSA approval for specialized services or products in Broomall.

Submitting Your Letter for FSA and HSA Reimbursement

I submit my letter of medical necessity along with supporting receipts directly to the FSA or HSA plan administrator. I ensure every form and attachment is complete to increase the chances of approval.

Tips for a Smooth Reimbursement Process

- Gather Required Documentation: I collect a signed letter of medical necessity, itemized receipts, and invoices detailing each FSA or HSA expense in Broomall.

- Use Provider Templates: I use letter templates provided by local healthcare facilities when possible because they often align better with FSA and HSA administrator requirements.

- Double-Check Plan Requirements: I review my plan's online portal for specific submission instructions, as administrators may require forms or online uploads in Broomall.

- Submit Promptly: I submit claims soon after my date of service to avoid missing reimbursement deadlines set by my FSA or HSA plan.

Avoiding Common Mistakes

- Incomplete Letters: I confirm that my letter includes all necessary details such as diagnosis code, treatment justification, and provider credentials before submission.

- Missing Receipts: I attach receipts showing full payment to my letter, since missing documentation often leads to denials.

- Illegible Information: I scan or photograph documents clearly, making sure every word is readable for Broomall plan admins.

- Overlooking Plan-Specific Forms: I use correct forms required by my FSA or HSA provider for medical necessity claims to speed up processing.

Choosing the Right Provider in Broomall

Selecting a healthcare provider in Broomall for an FSA or HSA letter of medical necessity depends on factors that impact claim approval and reimbursement speed.

- Relevant Experience: I check providers who regularly issue letters for FSA and HSA claims, such as primary care physicians, pediatricians, or specialists. Providers with this experience know required details, reducing the risk of incomplete documentation.

- Understanding of IRS and Plan Guidelines: I ensure the provider stays updated on IRS regulations and administrator-specific documentation requirements. Knowledge of plan guidelines means fewer issues when submitting claims for nontraditional treatments or equipment.

- Prompt Communication: I prioritize offices with a reputation for responsive scheduling and turnaround, especially for time-sensitive FSA claims. Quick communication helps me meet plan deadlines and avoid forfeiting funds.

- Completed Templates or Forms: I ask providers if they offer prefilled templates that meet administrator standards. Using their templates streamlines my process and reduces errors.

- Coordination with Local Pharmacies and Therapists: I look for providers who coordinate with local pharmacies and therapists in Broomall. This connection is especially helpful when multiple professionals contribute to diagnosis and treatment documentation, like for developmental therapies or recurring prescriptions.

I gather all necessary documentation after confirming the provider’s approach and experience. This diligence improves approval odds for FSA or HSA purchases that need a letter of medical necessity in Broomall.

Conclusion

Navigating FSA and HSA requirements in Broomall doesn't have to be overwhelming. When I take the time to understand my plan details and work closely with knowledgeable healthcare providers I'm setting myself up for smoother reimbursement and fewer surprises.

Staying proactive about documentation and deadlines helps me make the most of my health savings. With the right approach I can confidently manage my medical expenses and maximize the benefits available to me in Broomall.