FSA HSA Letter of Medical Necessity Villanova: Guide to Approval & Claims for 2024

Navigating the world of health savings accounts can get confusing fast especially when it comes to using your FSA or HSA for certain medical expenses. I’ve learned that sometimes you need more than just a receipt—you need a letter of medical necessity to get those expenses approved. If you’re in Villanova and wondering how to make your health dollars go further you’re not alone.

Whether you’re managing chronic conditions or just trying to maximize your benefits understanding when and how to get a letter of medical necessity can save you time and money. I’ll break down what you need to know so you can confidently use your FSA or HSA and avoid any surprises.

Understanding FSA and HSA Accounts

Flexible spending accounts (FSAs) and health savings accounts (HSAs) both offer tax-advantaged ways to pay for eligible medical expenses. I use specific criteria to determine which expenses qualify under each plan.

FSAs are employer-established plans letting me set aside pre-tax dollars for qualified medical costs, such as doctor visits, prescriptions, or medical devices. HSAs are accounts I own and control personally, available if I’m enrolled in a high-deductible health plan (HDHP). Contributions to an HSA remain tax-free, and funds roll over yearly without expiration.

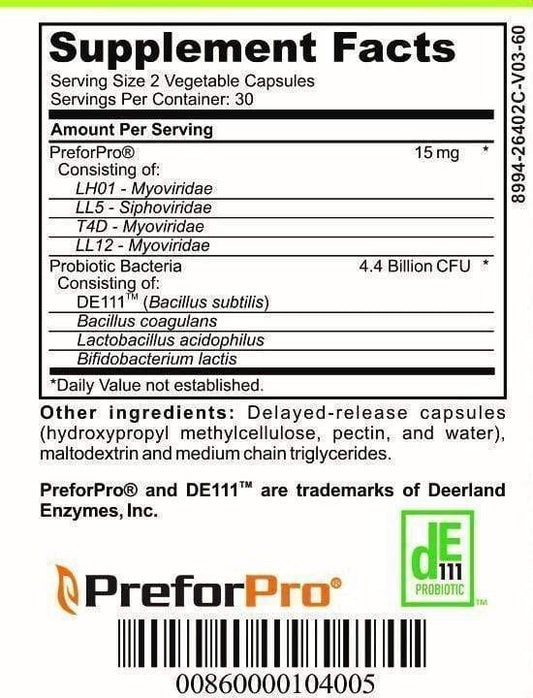

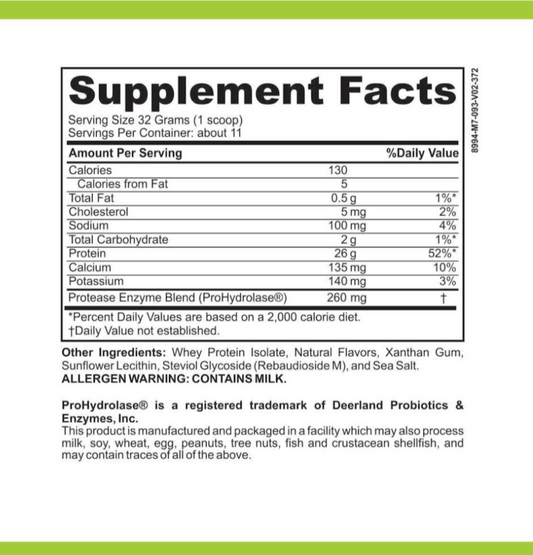

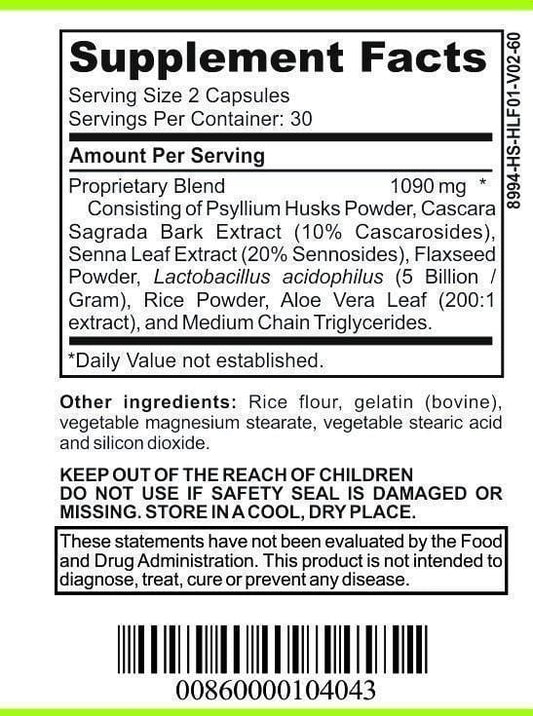

Both account types cover IRS-approved expenses (26 CFR §1.213-1), but certain products, such as vitamins, supplements, or alternative therapies, need additional documentation. I often provide a letter of medical necessity along with receipts to support claims for these items.

I track annual limits and eligibility. In 2024, FSA contributions cap at $3,200, while HSA maximums are $4,150 for individuals or $8,300 for families. My employer may set lower limits or offer unique features, like grace periods or carryovers, for FSAs.

For Villanova residents using local healthcare networks, understanding the distinctions between these accounts, eligible expenses, and documentation requirements like the letter of medical necessity reduces claim denials and optimizes tax savings.

What Is a Letter of Medical Necessity?

A letter of medical necessity supports FSA or HSA claims when expenses fall outside standard eligible items. I use this document to certify a treatment, service, or product as medically required after a healthcare provider's assessment in Villanova.

Purpose and Importance

A letter of medical necessity justifies why a specific product or service is essential for a diagnosed medical condition, not just for general health or comfort. I submit this letter to document my medical provider’s recommendation to the plan administrator or benefits provider. The letter helps me validate expenses not automatically covered under standard FSA or HSA lists—like a specific therapy or device—ensuring IRS compliance and reducing the chance of claim denial.

Common Scenarios Requiring a Letter

Certain FSA or HSA claims need a letter of medical necessity in Villanova. I use one for these instances:

- Specialized Treatments: Physical therapy, chiropractic care, or acupuncture not always recognized as standard eligible expenses

- Medical Equipment: Air purifiers, orthopedic shoes, or breast pumps prescribed due to medical necessity

- Educational Services: Speech therapy or applied behavioral analysis for developmental disorders in children

- Dietary Needs: Nutritional supplements or weight-loss programs if prescribed for medical conditions

I provide the letter with my claim to document the medical justification and support approval for reimbursement.

How Villanova Approaches the Letter of Medical Necessity

Villanova handles requests for a letter of medical necessity through standardized processes built around compliance and transparency. I follow a defined procedure to ensure FSA and HSA submissions meet IRS and plan administrator criteria, minimizing processing delays for Villanova residents.

Typical Process at Villanova

Villanova healthcare providers review each patient's case before preparing a letter of medical necessity. I begin by scheduling an appointment and verifying whether the expense requires such documentation. Providers—like primary care physicians, specialists, or medical directors—assess the individual's health status and the proposed service or product. I communicate my medical needs, supplying relevant history and details to explain why standard treatments aren't sufficient. Providers complete the letter using Villanova's official template, including diagnosis, detailed explanation of need, and duration of necessity. I receive this document directly or through Villanova's secure patient portal, then attach it to my FSA or HSA claim submission.

Documentation Requirements

Villanova's letter of medical necessity includes elements strictly aligned with IRS guidelines and plan administrator criteria. I ensure the letter contains the following:

- Patient Identification: Name, date of birth, and contact information.

- Diagnosis and Medical Condition: ICD-10 codes along with a clinical summary.

- Treatment or Item Description: Specifics on prescribed service, device, or therapy (examples: physical therapy sessions, continuous glucose monitors, adaptive equipment).

- Medical Justification: Clear rationale explaining why this expense is essential for diagnosis, treatment, or prevention and why less costly alternatives don't apply.

- Provider Credentials: Signature, medical license number, and provider contact details.

- Effective Dates: Time frame showing coverage period for the recommended treatment or supply.

I keep copies of submitted documents and correspondence with Villanova in case FSA or HSA administrators require clarification. I use these letters solely for claims that involve qualified medical expenses outside the standard pre-approved list.

Tips for Getting Your FSA HSA Letter Approved in Villanova

Getting an FSA or HSA letter of medical necessity approved in Villanova depends on accurate documentation and active communication with healthcare providers. Following best practices reduces claim denials and simplifies the reimbursement process.

Working With Healthcare Providers

Collaborating with Villanova healthcare providers ensures precise letters that meet FSA or HSA requirements. I request a detailed assessment explaining why the recommended service or product is medically necessary rather than simply beneficial. I include diagnostic codes, provider credentials, length of treatment, and explicit medical justification, which local administrators frequently request. After receiving the letter, I verify that my name, provider NPI, treatment dates, and supporting rationale are accurate before submitting my claim.

Avoiding Common Pitfalls

Addressing common pitfalls helps maximize FSA or HSA claim approvals in Villanova. I don’t submit incomplete letters missing required patient or provider information. I avoid generic statements—Villanova’s FSA and HSA administrators typically reject letters that lack specificity around the medical need. I confirm my expense qualifies as “medically necessary” under the IRS definition before filing. I retain all original documents, since Villanova plan administrators may request additional proof during audits or clarifications.

Conclusion

Making the most of your FSA or HSA in Villanova takes a bit of planning and the right documentation. I always recommend working closely with your healthcare provider to get a detailed letter of medical necessity when your expenses go beyond the usual list. Staying organized and proactive can help you avoid headaches with claim denials and keep your benefits working for you. If you have any doubts about your expenses or the documentation needed, don't hesitate to reach out to your provider or plan administrator for guidance.