FSA HSA Letter of Medical Necessity Oaks: Guide to Approval, Requirements & Tips

Navigating the world of health savings accounts can get confusing fast especially when it comes to getting the most out of my FSA or HSA. I’ve learned that some medical expenses need more than just a receipt—they require a letter of medical necessity. If you’re in Oaks and wondering how this process works you’re not alone.

I know how important it is to make every healthcare dollar count. That’s why understanding when and how to use a letter of medical necessity can make a real difference. Let’s break down what this document is why it matters for FSA and HSA reimbursements and how folks in Oaks can handle the paperwork with confidence.

What Is an FSA HSA Letter of Medical Necessity?

An FSA HSA letter of medical necessity documents a healthcare provider's statement confirming a specific product or service as essential to treat a medical condition. I submit it with my FSA or HSA reimbursement claim when an item doesn't automatically qualify as a covered expense—for example, massage therapy, certain supplements, or specialized medical equipment. The IRS requires this letter to confirm that the expense is not merely beneficial but is medically required to treat a diagnosed condition, not just for general health.

Doctors or licensed providers in Oaks typically issue letters of medical necessity on their official letterhead, including details such as my diagnosis, recommended treatment, and how the product or service supports the treatment plan. FSA and HSA administrators in Oaks accept only valid letters containing these elements, which include my provider’s name, signature, description of the item or service, medical diagnosis, and duration for which the item is needed.

Employers and benefits administrators in Oaks follow federal guidelines outlined in IRS Publication 502 when reviewing these letters and the related FSA HSA reimbursement requests. If the documentation doesn't satisfy these requirements, the request faces denial.

Why You Might Need a Letter of Medical Necessity in Oaks

A letter of medical necessity assists residents in Oaks when requesting FSA or HSA reimbursement for expenses that do not automatically qualify. I provide clear documentation to show why a product or service is essential for the treatment of a diagnosed condition, supporting compliance with plan rules and IRS regulations.

Common Qualifying Expenses

Many expenses in Oaks require a letter of medical necessity before FSA or HSA funds are released.

- Specialized therapies: Physical therapy, behavioral therapy, and chiropractic care need documented reasons beyond routine health maintenance.

- Medical equipment: Items like CPAP machines, breast pumps, and orthopedic devices qualify with proof of medical requirement.

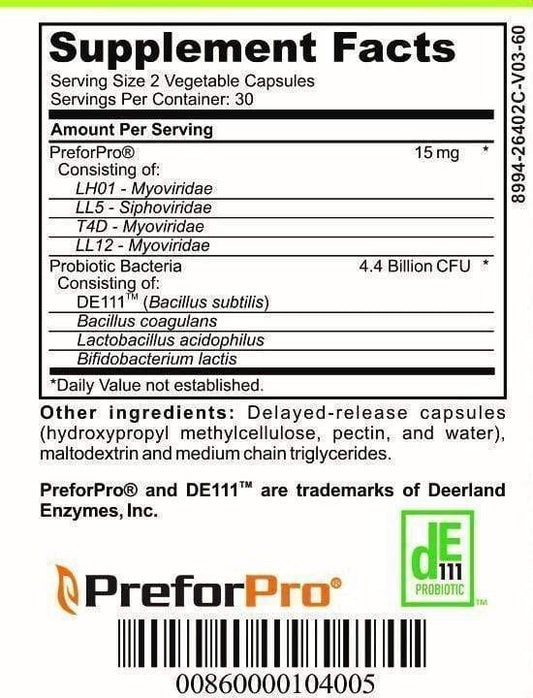

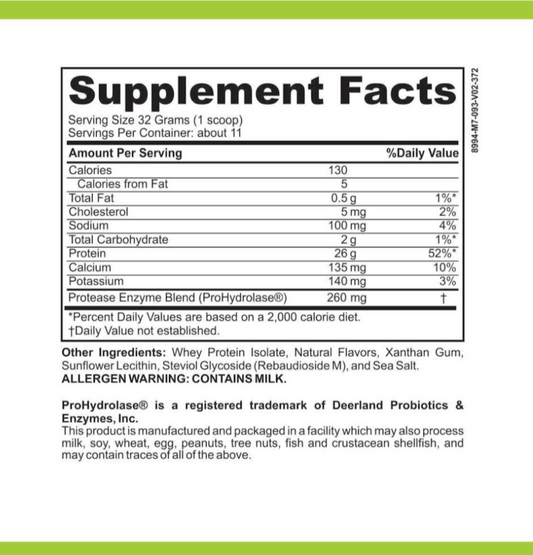

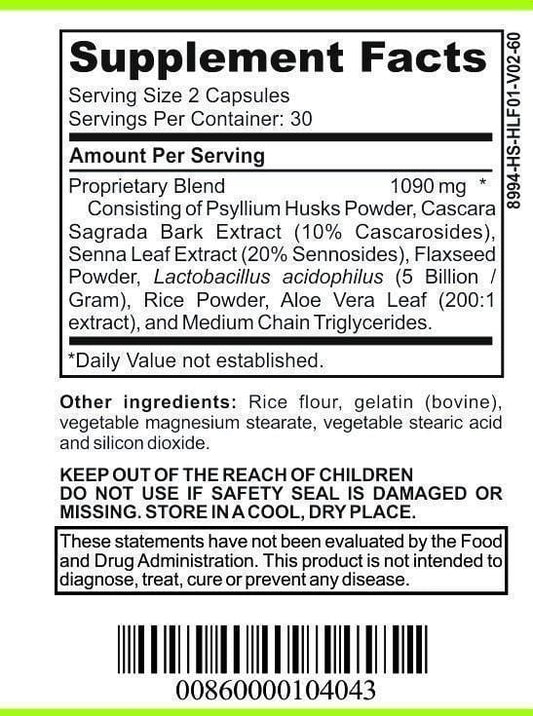

- Supplements and treatments: Nutritional supplements, some medications, and alternative treatments (like acupuncture) require a clinician's statement verifying medical need.

- Educational services: Special education, tutoring for learning disabilities, and certain therapy programs qualify with a provider’s substantiation.

Who Can Write the Letter?

Only a licensed healthcare provider in Oaks may issue a letter of medical necessity. I ensure the document includes the provider's credentials, medical diagnosis, and a detailed explanation of why the item or service is necessary for health outcomes. Doctors, nurse practitioners, physician assistants, and clinical specialists (examples include psychiatrists or physical therapists) meet most plan requirements for legitimizing these letters.

Steps to Obtain an FSA HSA Letter of Medical Necessity in Oaks

Obtaining an FSA HSA letter of medical necessity in Oaks requires careful planning and coordination between me and my healthcare provider. Each step connects to clear documentation and communication to fulfill FSA and HSA administrator requirements.

Gathering Required Documentation

Collecting thorough documentation establishes the basis for my letter of medical necessity in Oaks. I always assemble:

- Specific diagnosis codes from my medical records that match the expense

- Treatment plans outlining frequency, duration, and type of care or product needed

- Prescription or physician’s recommendation supporting the requirement

- Receipts, invoices, or estimates related to the medical expense

Accurate, complete records minimize delays in the approval and reimbursement process.

Talking to Your Healthcare Provider

Discussing my intent with my healthcare provider ensures the letter addresses Oaks-area FSA and HSA administrator requirements. I:

- Clearly explain the expense I plan to submit for reimbursement

- State how the product or service supports my medical treatment and well-being

- Request that my provider lists their credentials, the ICD-10 diagnosis code, and a justification that aligns with IRS guidelines

Timely, well-prepared communication secures a letter that supports my claim and adheres to Oaks regulations for FSA and HSA submissions.

Tips for Submitting Your Letter Successfully

- Confirming Eligibility

I check that my expense requires a letter of medical necessity by verifying the current IRS and plan administrator guidelines for HSA and FSA accounts in Oaks. For example, items like orthopedic shoes, nutritional supplements, and physical therapy often need documentation.

- Providing Complete Documentation

I include all mandatory elements in my submission: provider letterhead, detailed diagnosis, course of treatment, and the provider’s signature. Each section must be clearly labeled, or Oaks FSA HSA administrators may reject my claim.

- Using the Correct Forms

I attach the letter to any claim forms required by my FSA or HSA provider since missing paperwork delays reimbursement. Most administrators in Oaks offer downloadable claim forms on their official websites.

- Submitting Promptly

I always submit my letter and claims soon after incurring the expense. Oaks plan administrators sometimes process on a rolling basis, and prompt submission avoids expired claim windows.

- Keeping Copies

I retain digital and paper copies of every letter, form, and claim confirmation. This step allows me to respond quickly if administrators request follow-up documentation or clarification.

- Following Up Proactively

I monitor my FSA or HSA account status for the reimbursement update. If administrators in Oaks request corrections, I ask my healthcare provider to revise and resubmit documents as needed.

- Including Supporting Materials

I add proof of payment and other supporting receipts when submitting my letter for medical necessity. These documents boost claim validation rates in Oaks.

| Submission Tip | Context Example | Benefit in Oaks |

|---|---|---|

| Confirm eligibility | Check IRS list for needed items | Prevents ineligible claim denial |

| Provide full details | Add diagnosis, Rx, and doctor credentials | Meets administrator requirements |

| Use required forms | Submit on official FSA/HSA claim documents | Streamlines processing |

| Submit promptly | File after purchase within plan deadlines | Avoids missing claim windows |

| Keep copies | Save PDFs and paper files | Eases dispute or re-filing |

| Follow up | Contact administrator if processing is delayed | Ensures timely reimbursement |

| Add supporting materials | Include receipts and payment records | Strengthens claim approval |

Common Mistakes to Avoid

Incorrect provider credentials can lead to claim denial if the letter isn’t signed by a licensed provider in Oaks.

Missing required information, for example omitting diagnosis codes, dates of service, or a specific treatment explanation, causes administrative rejection.

Vague explanations from physicians, such as describing an item as “helpful” instead of “medically necessary,” make approval unlikely.

Outdated documents, like using a last year’s letter, often don’t meet current FSA or HSA guidelines in Oaks.

Unsubmitted supporting materials, such as receipts or prescriptions, prevent administrators from fully verifying claims.

Noncompliance with FSA or HSA plan deadlines causes otherwise eligible claims for Oaks residents to be automatically rejected.

Failure to check plan exclusions, like submitting for cosmetic products that aren’t eligible even with a letter, wastes time and risks future denials.

Incomplete claim forms, including leaving mandatory fields blank, delays processing and stretches reimbursement timelines.

Repeated resubmissions, due to unresolved errors, flag my claims in Oaks’ FSA or HSA systems for further review.

Conclusion

Navigating FSA and HSA reimbursement in Oaks can feel overwhelming but having the right letter of medical necessity makes a huge difference. I’ve found that staying organized and working closely with my healthcare provider helps me avoid common pitfalls and delays.

With careful planning and attention to detail it’s possible to get the most out of your benefits and ensure your qualified expenses are covered. Taking the time to understand the process now can save you stress and money down the road.