FSA HSA Letter of Medical Necessity Mont Clare: Guide to Maximizing Benefits and Approval

Navigating the world of healthcare savings can feel overwhelming, especially when it comes to getting the most out of my Flexible Spending Account (FSA) or Health Savings Account (HSA). I quickly learned that some expenses require more than just a receipt—they need a Letter of Medical Necessity. If you’re in Mont Clare like me, understanding what this letter is and how to get one makes a huge difference in maximizing your benefits.

I’ve found that knowing the right steps saves time and money, letting me focus on my health instead of paperwork. Whether you’re new to FSAs and HSAs or just want to make sure you’re using them to their full potential, I’ll break down what you need to know about Letters of Medical Necessity in Mont Clare.

Understanding FSA and HSA Accounts

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) allow me to set aside pre-tax funds for qualified health expenses. FSAs connect to employer health plans and follow annual contribution limits, with the IRS listing the maximum for 2024 as $3,200. HSAs pair with high-deductible health plans (HDHPs) and offer a 2024 contribution max of $4,150 for individuals and $8,300 for families, source: IRS Publication 969.

Funds in my FSA typically expire at year-end, with some plans offering a grace period or a $610 carryover for 2024. HSA balances roll over without expiration, supporting long-term healthcare planning. Both accounts cover eligible medical expenses, such as prescriptions, copays, and medical supplies, but certain items in Mont Clare, like massage therapy or vitamins, require documentation such as a Letter of Medical Necessity.

FSAs limit my control over account management, with the employer holding the funds, while HSAs provide individual ownership and the option for investment growth. I use this flexibility when budgeting for anticipated healthcare needs. HSAs grant tax advantages—contributions, growth, and qualified withdrawals remain tax-free.

Account differences impact expense eligibility and the process for securing a Letter of Medical Necessity in Mont Clare. I reference my plan details to align account usage with qualified medical expenses and ensure compliance with IRS and employer requirements.

What Is a Letter of Medical Necessity?

A Letter of Medical Necessity explains why a specific treatment, service, or product counts as essential for health. I rely on these formal documents to get FSA or HSA coverage for medical items that don't automatically meet eligibility rules.

Purpose of a Letter of Medical Necessity

This document demonstrates to my FSA or HSA administrator that a non-standard medical expense relates directly to a diagnosed condition. Providers create these letters when products or services—like physical therapy equipment, weight-loss programs, or alternative therapies—require medical evidence for reimbursement. I use this letter to ensure compliance with IRS guidelines and satisfy plan administrator requests in Mont Clare.

Key Components of the Letter

Each Letter of Medical Necessity includes specific information:

- Patient Identification: Name, date of birth, and insurance details match my account.

- Diagnosis Statement: Clear description of my diagnosed medical issue.

- Prescribed Treatment: Provider lists the exact service, product, or therapy and justifies its necessity.

- Duration of Need: Timeframes—such as “12 months”—outline how long I’ll require the expense.

- Provider Credentials: Licensed medical provider’s signature, printed name, and contact info verify the recommendation.

I present these details to my plan administrator, streamlining approval and reimbursement for my Mont Clare healthcare expenses.

Obtaining an FSA HSA Letter of Medical Necessity in Mont Clare

Obtaining an FSA HSA letter of medical necessity in Mont Clare involves coordinating with local healthcare providers and following a straightforward process. Understanding local documentation requirements streamlines FSA HSA account management and expense approval.

Local Healthcare Providers and Documentation

Local healthcare providers in Mont Clare, such as primary care physicians and specialists, supply the necessary documentation for a letter of medical necessity. I request this letter directly from my provider, ensuring it includes my diagnosis, recommended treatment, duration of medical need, and provider credentials. Mont Clare clinics frequently use templates matching IRS and insurance requirements, so I confirm the letter references the specific treatment or product for my FSA HSA reimbursement. Providers maintain electronic health records, which speeds up the issuance of required documents for submission.

Steps to Request the Letter

Requesting a letter of medical necessity in Mont Clare involves a stepwise approach:

- Schedule an appointment with my healthcare provider, specifying the need for FSA or HSA documentation.

- Prepare a list of treatments or products requiring coverage, such as physical therapy, orthotics, or specialized medications.

- Discuss my condition during the appointment, ensuring the provider documents each item and matches account guidelines.

- Ask for a signed, printed letter, outlining the diagnosis, prescribed treatment, medical necessity, and provider identification.

- Submit the letter to my FSA or HSA administrator according to platform instructions, keeping a copy for my records.

I follow these steps with each new qualified purchase, helping ensure compliance and faster claim approval in Mont Clare.

Eligible Expenses Covered by a Letter of Medical Necessity

A Letter of Medical Necessity expands FSA and HSA reimbursement in Mont Clare to include items not automatically qualified by IRS standards. I rely on this letter when justifying certain health-related expenses beyond generic care products.

Common Qualified Products and Services

I use a Letter of Medical Necessity to claim coverage for the following:

- Therapy Services: Physical, occupational, and speech therapy sessions become eligible if my provider details the medical need.

- Alternative Treatments: Acupuncture, chiropractic care, and massage therapy qualify with documentation specifying a diagnosed condition.

- Medical Equipment: Reimbursement extends to devices such as TENS units, CPAP machines, and orthopedic shoes when prescribed for specific medical reasons.

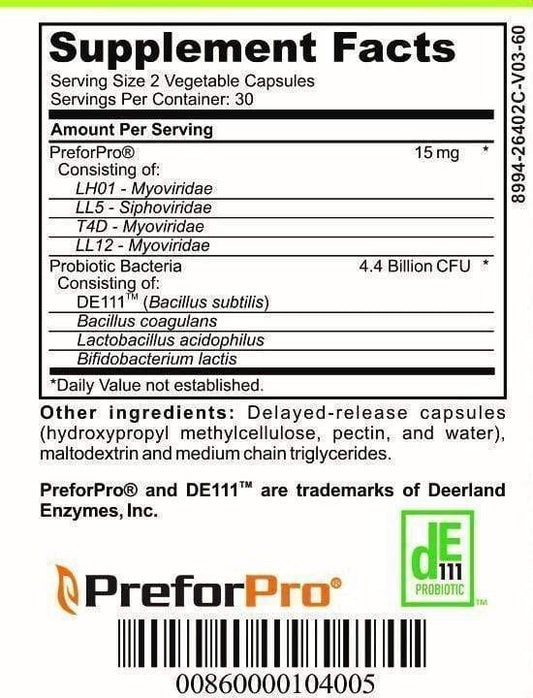

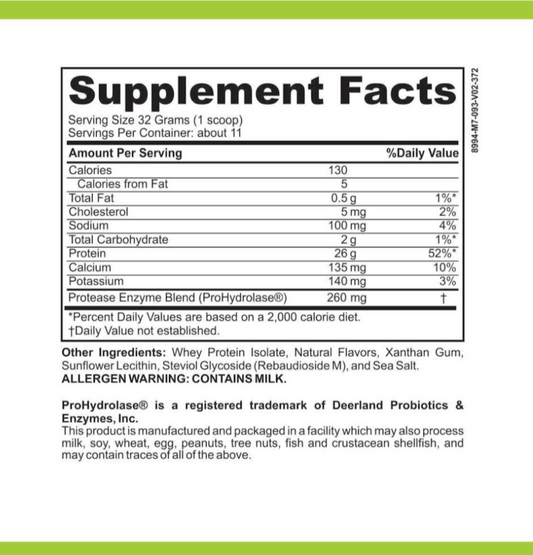

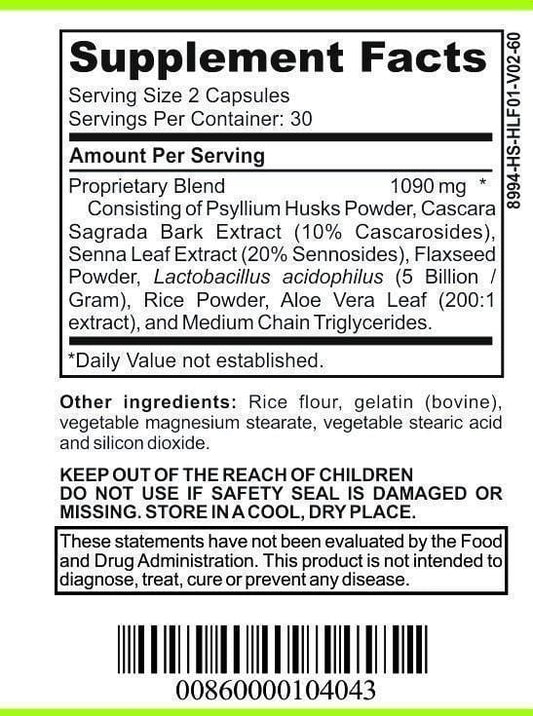

- Nutritional Supplements: Specialized vitamins and supplements qualify if my healthcare provider documents their necessity for a diagnosed deficiency, as in the case of prescribed Vitamin D for osteoporosis.

- Behavioral Health Programs: Weight-loss, smoking cessation, or sleep disorder treatments receive approval if the statement links the service to a medical diagnosis.

- Special Education Services: Tutoring and specialized learning tools get covered for conditions like ADHD when my doctor supports the requirement.

Special Considerations for Mont Clare Residents

Mont Clare residents experience certain unique factors when using FSAs and HSAs:

- Local Healthcare Availability: Access to qualifying services, such as specific therapies or specialists, may depend on local provider competition and referral networks.

- Provider Familiarity: Some Mont Clare clinics are more accustomed to preparing Letters of Medical Necessity for FSA/HSA reimbursement, speeding up documentation.

- Regional Plan Differences: Employers in Mont Clare may set stricter plan requirements, so I check local guidelines to confirm what my plan administrator considers eligible.

- Community Health Trends: I see higher demand for allergy treatments and behavioral therapies among Mont Clare residents, increasing reliance on physician documentation for coverage.

By understanding these eligible expenses and Mont Clare-specific details, I align my FSA and HSA usage with both IRS standards and my local requirements.

Tips for a Smooth Reimbursement Process

Efficient FSA and HSA reimbursements in Mont Clare depend on careful preparation and documentation. I coordinate my submissions to meet both IRS guidelines and my employer or HSA provider’s requirements.

Submitting Your Letter and Claims

I submit my Letter of Medical Necessity with itemized receipts and a completed reimbursement form through my FSA or HSA account portal. I verify all documents use consistent patient, provider, and procedure names to match official records. I retain digital copies of submissions for my records and follow up with my plan administrator if I haven’t received confirmation within 10 business days. Some plans in Mont Clare use specific submission formats or online platforms, so I check my plan’s instructions before sending materials.

Avoiding Common Mistakes

I double-check that my Letter of Medical Necessity includes all required information—diagnosis, prescribed treatment, provider signature, and duration. I avoid using vague or general language in letters or receipts, as this often results in claim denials. I keep my provider’s contact information accessible, in case administrators request clarification. I ensure eligible items are listed in the IRS guidelines and attach any additional documentation for expenses such as supplements or special therapies. In Mont Clare, I check if my local provider’s template matches my plan’s current requirements, since outdated forms frequently slow the process.

Conclusion

Navigating FSA and HSA requirements in Mont Clare doesn’t have to be overwhelming. I’ve found that taking the time to understand the process and working closely with healthcare providers makes a real difference. When you’re organized and proactive about documentation you can make the most of your benefits and focus on what truly matters—your health and peace of mind.