FSA HSA Letter of Medical Necessity Glen Mills: Guide to Maximizing Your Healthcare Savings

When it comes to making the most of my healthcare dollars in Glen Mills I know how important it is to understand the ins and outs of Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA). One thing that often trips people up is the letter of medical necessity—a document that can make or break whether certain expenses get reimbursed.

I’ve found that getting this letter right can save me a lot of hassle and money. Whether I’m looking to cover specialized treatments or over-the-counter products, knowing when and how to request a letter of medical necessity is key. Let’s break down why this letter matters so much for FSA and HSA users in Glen Mills and how it can help me maximize my benefits.

Understanding FSA and HSA Accounts

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) offer tax-advantaged ways to manage healthcare expenses for Glen Mills residents. I use an FSA by contributing pre-tax earnings into an account that covers qualified medical, dental, and vision expenses—examples include prescriptions, copays, and some over-the-counter products. Annual FSA contributions for 2024 cap at $3,050 according to IRS guidelines.

I access an HSA only if I enroll in a qualified high-deductible health plan. HSA funds accumulate tax-free, roll over year-to-year, and support expenses such as deductibles or specialist visits. For 2024, individual HSA contribution limits reach $4,150 and family limits reach $8,300.

I select FSA or HSA accounts based on employer offerings, coverage needs, and tax advantages. In both account types, the documentation of expenses remains crucial for reimbursement, especially when a letter of medical necessity is required for items like therapy or medical equipment.

What Is a Letter of Medical Necessity?

A letter of medical necessity documents why a specific healthcare service, item, or product is essential for diagnosing, treating, or preventing a medical condition. My healthcare provider prepares this letter when expenses don’t automatically qualify for reimbursement through my FSA or HSA under Glen Mills guidelines.

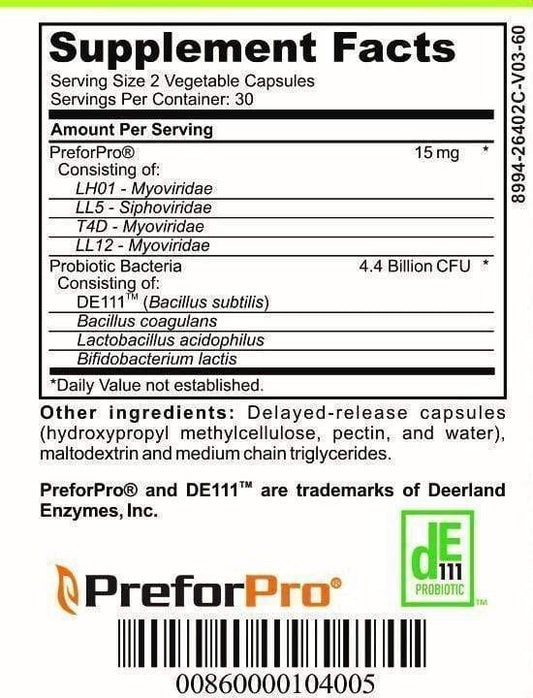

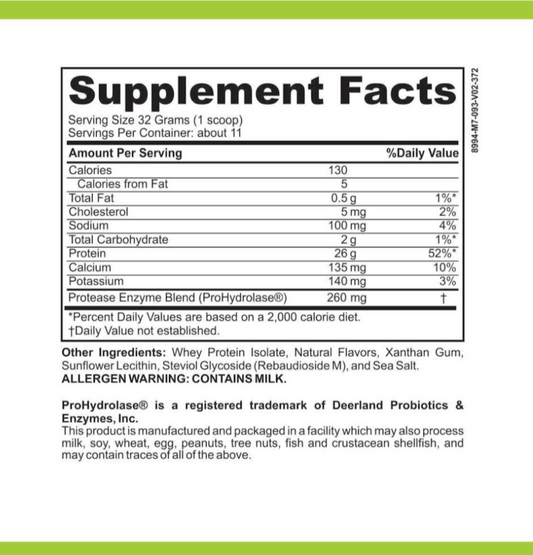

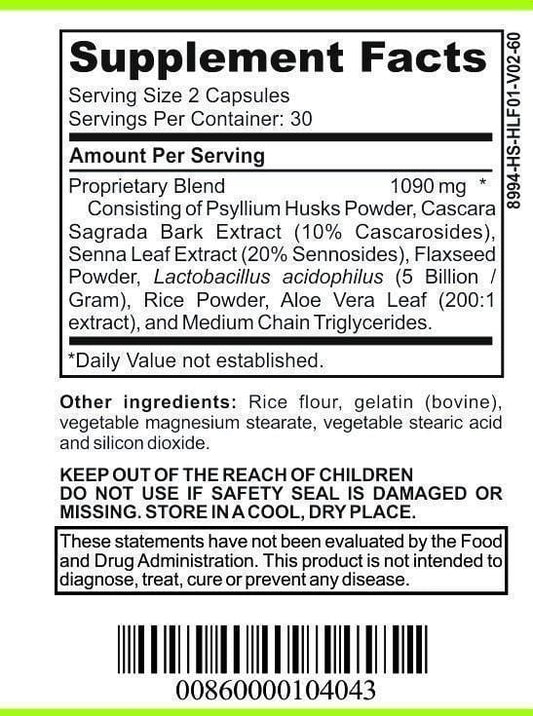

I submit a letter of medical necessity when I claim expenses for specialized services or products, such as medical equipment, nutritional supplements, or particular therapy sessions. Each letter typically describes my condition, lists the recommended treatment or item, and explains why standard solutions aren’t sufficient. My FSA or HSA administrator reviews this letter to confirm that my request meets IRS and plan-specific criteria before releasing funds or reimbursing eligible purchases.

Obtaining a letter of medical necessity eliminates confusion during the reimbursement process in Glen Mills, especially for items like over-the-counter medications, custom orthotics, or acupuncture sessions. My provider’s detailed input supports my claim and ensures my FSA or HSA funds cover approved healthcare costs efficiently.

Why You Need a Letter of Medical Necessity in Glen Mills

A letter of medical necessity confirms that a specific healthcare item or service is essential for diagnosis, treatment, or prevention. I rely on this document in Glen Mills whenever FSA or HSA reimbursement claims go beyond standard covered expenses.

Common Situations Requiring a Letter

- Over-the-counter products: Reimbursement for items like pain relievers, allergy medications, or prenatal vitamins depends on a letter explaining their medical purpose.

- Alternative therapies: Claims for services such as acupuncture, chiropractic sessions, or therapeutic massages require provider documentation of medical necessity.

- Medical equipment: Coverage for custom orthotics, CPAP machines, or durable equipment like wheelchairs typically relies on a detailed letter.

- Specialized dietary needs: Claims for nutritional supplements or specialty formula need proof that they're essential for managing a diagnosed medical condition.

- Education or treatment programs: Programs for behavioral therapies or weight-loss management, if advised for a specific medical issue, often demand a supporting letter.

Benefits for Glen Mills Residents

- Expanded reimbursement options: I access coverage for broader services, including non-standard treatments and products, by submitting a proper letter.

- Streamlined claim approvals: Well-prepared documentation from healthcare providers reduces claim rejection rates and avoids processing delays in Glen Mills.

- Improved compliance: Detailed letters align my claims with IRS requirements and Glen Mills-specific plan criteria, minimizing audit risks.

- Maximized tax savings: By ensuring eligibility for more expenses, I increase potential FSA and HSA tax advantages each year.

How to Obtain an FSA HSA Letter of Medical Necessity in Glen Mills

Securing a letter of medical necessity is key for FSA and HSA reimbursement of certain healthcare expenses in Glen Mills. My focus in this section is the exact process local patients and healthcare providers follow to issue and use these letters.

Steps for Patients

- Identify eligible expenses: I determine which healthcare products or services need a letter, using FSA/HSA plan details and IRS Publication 502 as references for Glen Mills.

- Contact my healthcare provider: I reach out to my primary care doctor or specialist with a request for a letter tailored to the required product, therapy, or equipment.

- Provide documentation: I supply relevant medical records, diagnoses, and treatment notes to support the necessity for the item or service.

- Submit the letter: I attach the provider’s completed letter to my FSA or HSA claim, following my plan administrator’s guidelines on documentation format and delivery.

- Track claim status: I monitor processing through my FSA/HSA portal, responding quickly if the administrator requests additional details or clarification.

Role of Healthcare Providers

- Assess medical necessity: My healthcare provider reviews my medical history and treatment plan to determine clinical justification for the requested item or service.

- Draft the letter: The provider prepares documentation stating my diagnosis, the recommended treatment, why it’s medically necessary, and the expected health benefits.

- Include required details: The letter lists my name, date of evaluation, provider’s credentials, and a specific description of the medical item, making it valid for Glen Mills FSA/HSA claims.

- Provide timely delivery: My provider supplies me with the signed letter or submits it directly to my benefits administrator when required.

These steps support claim approval and ensure compliance with Glen Mills-area FSA and HSA requirements.

Tips for Ensuring Your Letter Is Accepted

Use accurate diagnosis codes for Glen Mills FSA HSA submissions.

I include current ICD-10 codes in every letter, aligning them with the patient’s medical record. If codes are inconsistent, reimbursement processors in Glen Mills might reject the claim.

State medical necessity with clear connection to the requested item or service.

I specify how each product or service treats or manages a diagnosed condition, providing supporting clinical documentation if insurers in Glen Mills require verification.

Use provider details with credentials and contact information.

I list the provider’s name, credentials, NPI number, office address, and phone. Without these elements, Glen Mills administrators may not process the claim.

Provide treatment duration and frequency.

I document the recommended length and frequency of use for the item, such as “12 months of weekly therapy” or “daily use of custom orthotics”, for clarity with Glen Mills FSA HSA forms.

Maintain original documentation for Glen Mills FSA HSA records.

I keep copies of both the submitted letter and supporting medical records. If the benefits administrator requests additional proof, these documents streamline the appeal process.

Follow Glen Mills FSA HSA plan guidelines and IRS requirements.

I review the specific plan details or talk to an FSA HSA administrator in Glen Mills to confirm that my letter format and content meet current local and federal standards.

Conclusion

Navigating the FSA and HSA process in Glen Mills doesn't have to be overwhelming when you know what's required for a letter of medical necessity. I've seen how taking the right steps and working closely with healthcare providers can make a real difference in getting claims approved.

By staying proactive and organized with your documentation you'll be able to take full advantage of your benefits and keep your healthcare expenses under control. If you're ever unsure about the process or requirements it's always best to reach out for expert advice to avoid unnecessary setbacks.