FSA HSA Letter of Medical Necessity Chester Springs: Guide to Claims & Local Resources

Managing healthcare expenses can feel overwhelming, especially when you're trying to make the most of your FSA or HSA benefits. I know how confusing it gets when you hear about a "letter of medical necessity" and wonder if you really need one for specific treatments or products. If you live in Chester Springs and want to maximize your savings while staying compliant, understanding this requirement is crucial.

I've learned that the right documentation can make all the difference when it comes to getting reimbursed. Whether you're dealing with specialty therapies or over-the-counter items, knowing when and how to request a letter of medical necessity can help you avoid costly mistakes. Let's dive into what you need to know to keep your healthcare spending on track in Chester Springs.

Understanding FSA and HSA Accounts

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) offer tax advantages for healthcare spending in Chester Springs and across the US. FSAs let me contribute pre-tax dollars through my employer for qualified medical expenses during a single plan year. HSAs pair with high-deductible health plans, letting me save funds tax-free, roll over unused balances each year, and use them for approved health-related costs.

Contribution limits for 2024 reach $3,200 for an individual FSA and $4,150 for an individual HSA, with the IRS overseeing annual adjustments. I generally can't use FSA or HSA funds for every healthcare item unless the IRS deems it eligible.

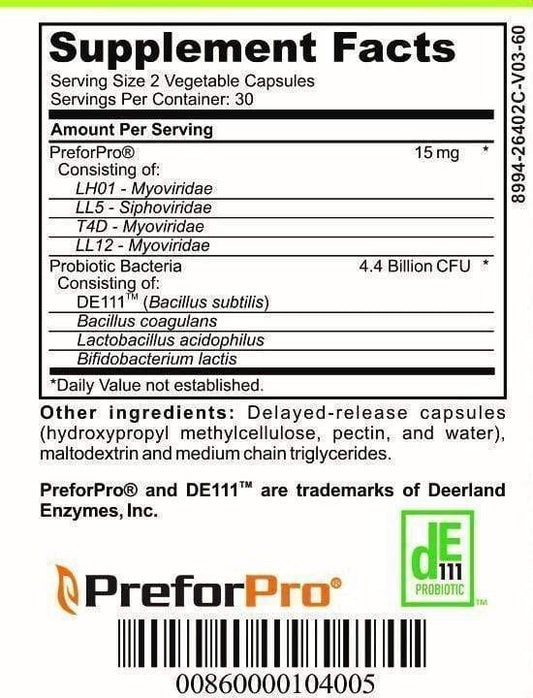

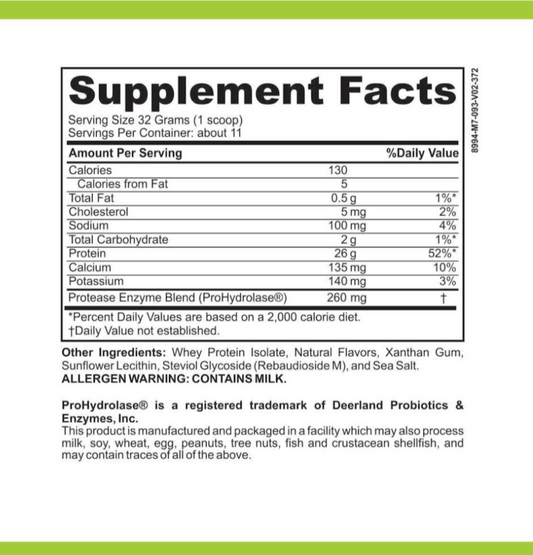

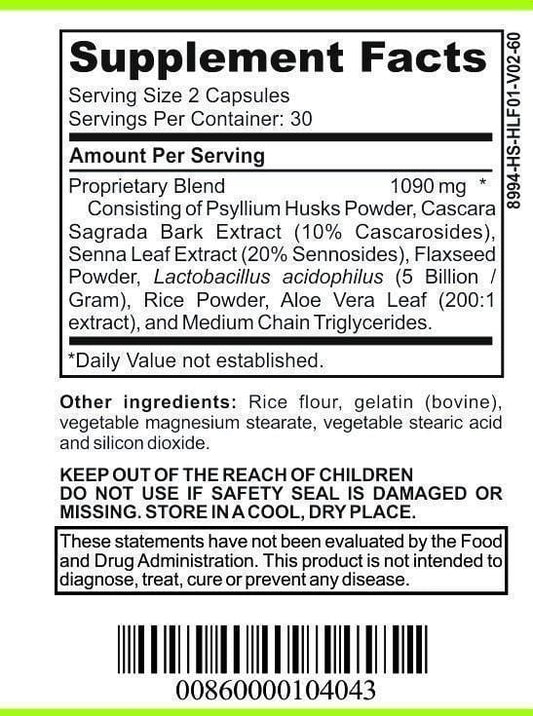

Covered expenses typically include doctor visits, prescription medications, lab tests, and medical devices like blood pressure monitors. Some over-the-counter items and specialty services such as acupuncture only qualify if I submit a letter of medical necessity from a licensed provider. IRS Publication 502 details these qualifying expenses.

Proper account management reduces my tax liability, increases healthcare budget flexibility, and lets me plan for out-of-pocket treatments in Chester Springs with confidence.

What Is a Letter of Medical Necessity?

A letter of medical necessity documents why a specific healthcare service or product meets a medical need. I use this letter to support reimbursement requests for expenses that aren't automatically approved under FSA or HSA rules in Chester Springs.

Importance for FSA and HSA Eligibility

A letter of medical necessity impacts whether FSA or HSA funds can cover certain services or items. I submit this letter to show that a product, therapy, or treatment prescribed by my healthcare provider addresses a specific diagnosis or medical condition and isn't for general well-being. Plan administrators in Chester Springs accept expenses like specialized therapy sessions, certain medical equipment, or specific nutritional supplements only when I've provided this documentation.

Typical Information Included

A letter of medical necessity typically contains several key details:

- Patient identification: My name, date of birth, and relevant medical history

- Provider credentials: The prescribing healthcare professional’s name, license number, and contact information

- Diagnosis: The specific condition or ICD-10 code being treated

- Recommended treatment: The product, medication, or service and why it's medically necessary

- Duration: The expected time window in which I need the recommended intervention

- Signature: The provider’s dated signature confirming the need for the service or product

I ensure this information is complete to speed up FSA or HSA claims in Chester Springs.

How to Obtain a Letter of Medical Necessity in Chester Springs

Navigating the process for an FSA or HSA letter of medical necessity in Chester Springs takes precise steps and clear documentation. I'll describe the main actions to get this letter and address obstacles that can impact claim approval.

Steps to Request From Your Healthcare Provider

- Schedule Appointment: I book a visit with my licensed healthcare provider in Chester Springs to discuss my medical need related to FSA or HSA reimbursement.

- Explain Need: I give my provider clear details about the specific service, product, or treatment I want covered and mention my FSA or HSA requirements.

- Provide Account Details: I show my provider the FSA or HSA administrator's requirements for a letter of medical necessity, as outlined in Chester Springs plan documents or official websites.

- Gather Supporting Documentation: I bring recent diagnoses, prescriptions, or medical records that support medical necessity for the recommended service or product.

- Request Letter: I ask my provider to draft the letter, making sure it includes required information—patient details, diagnosis, recommended treatment, duration, and provider credentials.

- Review and Submit: I review the letter for accuracy then submit it directly to my FSA or HSA plan administrator using their preferred process, such as online portals or physical mail.

Common Challenges and Solutions

- Incomplete Letters: Missing diagnosis codes, provider signatures, or treatment details often cause claim denials. I double-check that my provider includes all required information before submission.

- Provider Unfamiliarity: Some Chester Springs providers may not know FSA or HSA documentation standards. I share sample templates or guidance from my benefits provider to streamline their process.

- Delayed Responses: Scheduling delays or backlogs disrupt timely filing. I request my letter during the appointment and follow up with my provider’s office if I don’t receive it within 5–7 business days.

- Plan-Specific Requirements: FSA and HSA plans may have unique forms or stipulations. I confirm these by reviewing plan materials or contacting the administrator directly for Chester Springs–specific guidance.

| Challenge | Solution |

|---|---|

| Incomplete letters | Confirm all required sections before submission |

| Provider unfamiliarity | Give templates or FSA/HSA plan instructions to the provider |

| Delayed responses | Request during appointment and follow up after 5–7 business days |

| Plan-specific requirements | Check plan documents and consult the administrator for local details |

Best Practices for Submitting Your Letter

Submitting a letter of medical necessity with FSA or HSA claims in Chester Springs requires accuracy, organization, and proactive communication. I streamline the process and reduce claim denials by applying proven steps.

Ensuring Approval by Your FSA or HSA Plan

I verify the letter complies with my specific plan's requirements by reviewing the Summary Plan Description and claim submission forms before uploading any documents. I ensure my provider includes:

- Patient name, date of birth, and diagnosis (e.g., migraine, asthma)

- Prescribed treatment or product (e.g., physical therapy, CPAP machine)

- Medical necessity statement linking the diagnosis to the recommended intervention

- Duration of need (e.g., six months, one year)

- Provider signature, credentials, and contact information

I confirm that terminology used in the letter matches language outlined in the plan’s eligible expense list to avoid processing delays.

Keeping Documentation Organized

I store all FSA and HSA paperwork for tax and audit purposes, retaining digital copies of letters of medical necessity, prescriptions, and claim correspondence. I use a folder structure on my device labeled by year and account type. For larger claims or ongoing treatments, I maintain a log with dates of submission, provider contact information, and claim reference numbers, ensuring fast retrieval if the plan administrator requests additional details. I also periodically review plan notices and reminders to keep my paperwork up-to-date.

Local Resources in Chester Springs

Dental offices, primary care clinics, and specialty providers in Chester Springs offer support for patients managing FSA HSA documentation. Regional healthcare professionals and support services help streamline the process for getting a letter of medical necessity and ensure proper submission for reimbursement.

Healthcare Providers Familiar With FSA HSA Requirements

Local clinics like Main Line Health Primary Care and Chester Springs Family Practice regularly assist patients with FSA HSA documentation for services including therapy, prescription medication, durable medical equipment, and pediatric care. Staff at these practices explain eligible expenses, review account information, and prepare detailed letters of medical necessity based on current plan requirements. Local pharmacies, such as Chester Springs Pharmacy, coordinate with prescribers to provide required language in documentation for over-the-counter and prescription items.

Where to Get Help With Your Application

I find specialized support for my FSA HSA applications at area hospitals' financial services departments, such as those at Paoli Hospital and Phoenixville Hospital, when I need guidance on insurance forms and claim submissions. Local insurance agents and independent benefit advisors, like those at Worthington Benefit Services, review my plan terms and help me customize medical documentation. Chester Springs pharmacies, local community health centers, and patient navigators at nearby health networks also offer application checklists, translation services, and digital submission support to reduce errors and delays related to medical necessity letters and claims.

Conclusion

Navigating FSA and HSA requirements in Chester Springs doesn’t have to feel overwhelming. With the right documentation and support from local providers, I’ve found it’s much easier to secure reimbursements and maximize my healthcare savings. Staying organized and proactive with my paperwork means fewer surprises during tax season and smoother claims overall. If you’re unsure where to start, reaching out to local clinics or insurance experts can make a big difference.