Can I Get a Discount on Ozempic If I Am on Medicare?

Navigating the world of Medicare can be tricky, especially when it comes to prescription medications like Ozempic. If you have Type 2 diabetes and are on Medicare, you might be wondering if you can get a discount on this medication. This article will guide you through the key points you need to know about Medicare coverage for Ozempic, including costs, eligibility, and ways to save.

Key Takeaways

- Medicare Part D plans may cover Ozempic for treating Type 2 diabetes, but not for weight loss.

- The cost of Ozempic under Medicare can vary based on your specific plan and its formulary.

- Eligibility for coverage often requires meeting certain criteria, including prior authorization.

- There are alternative ways to save on Ozempic, such as manufacturer assistance programs and prescription discount cards.

- Understanding your plan’s formulary and consulting with your healthcare provider can help you navigate the coverage process.

Understanding Medicare Coverage for Ozempic

What is Ozempic?

Ozempic is a brand name for semaglutide, a prescription medication made by Novo Nordisk. It is an injectable drug that helps control blood sugar levels in people with Type 2 diabetes. Ozempic is not approved by the FDA for weight loss, even though it has gained popularity for this off-label use.

Medicare Part D and Prescription Drug Coverage

Medicare Part D plans often cover Ozempic, but only for treating Type 2 diabetes. Each plan has its own list of covered drugs, known as a formulary, so it's important to check if Ozempic is included. Some plans may require prior authorization, meaning your doctor must get approval from the insurance company before you can get the medication.

Medicare Advantage Plans and Ozempic

Medicare Advantage plans, also known as Part C, usually include prescription drug coverage. These plans may also cover Ozempic for Type 2 diabetes. Just like with Part D, you should check the plan’s formulary to see if Ozempic is covered. If you receive Ozempic in a doctor's office, it might be covered under Medicare Part B instead.

If you have Type 2 diabetes, managing your condition with medications like Ozempic can help you maintain a healthier lifestyle. Always consult your healthcare provider to understand your treatment options.

Note: Medicare does not cover Ozempic for weight loss, as weight loss drugs are considered cosmetic and not essential for health.

Eligibility Criteria for Medicare Coverage of Ozempic

Type 2 Diabetes and Medicare

Medicare Part D plans often cover Ozempic if it's prescribed for managing Type 2 diabetes. Ozempic helps control blood sugar levels and can reduce the risk of heart problems in people with diabetes. However, each plan may have different rules, so it's important to check your specific plan.

Weight Loss and Medicare Restrictions

Medicare does not cover Ozempic if it's prescribed solely for weight loss. A law from 2003 prevents Medicare Part D from covering weight loss drugs because they were once seen as cosmetic. If you have Type 2 diabetes and are also dealing with obesity, your plan might cover Ozempic.

Prior Authorization Requirements

Some Medicare plans may require prior authorization for Ozempic. This means your doctor must get approval from the insurance company before you can get the medication. Sometimes, you might need to try other treatments first before Medicare will cover Ozempic.

It's crucial to understand your Medicare plan's rules and talk to your doctor about the best way to get coverage for Ozempic. In some cases, inositol supplements might be recommended as part of a broader treatment plan.

Cost of Ozempic Under Medicare Plans

Average Costs with Medicare

The cost of Ozempic can vary based on your specific Medicare plan. On average, Medicare beneficiaries might pay around $2,300 per year for Ozempic. This cost includes copayments, deductibles, and coinsurance. Each plan has its own formulary, which is a list of covered drugs, and Ozempic is often placed in the middle tiers.

Factors Influencing Costs

Several factors can influence the cost of Ozempic under Medicare plans:

- Plan Formulary: Each Medicare plan has a different list of covered drugs.

- Tier Placement: Drugs placed in higher tiers usually have higher copayments.

- Deductibles and Coinsurance: These out-of-pocket costs can vary by plan.

- Geographic Location: Prices can differ based on where you live.

Out-of-Pocket Maximums

For 2024, the maximum out-of-pocket expense for Medicare Part D is $8,000. This cap includes all covered medications, not just Ozempic. Once you reach this limit, your plan will cover most of the costs for the rest of the year.

It's important to check your specific plan details to understand your costs. Consulting with your healthcare provider can also help you navigate these expenses.

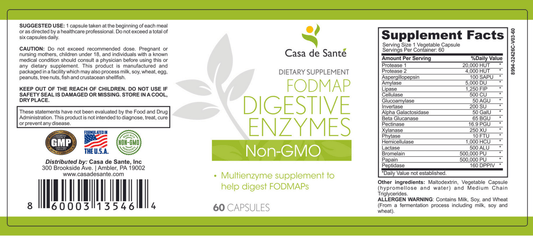

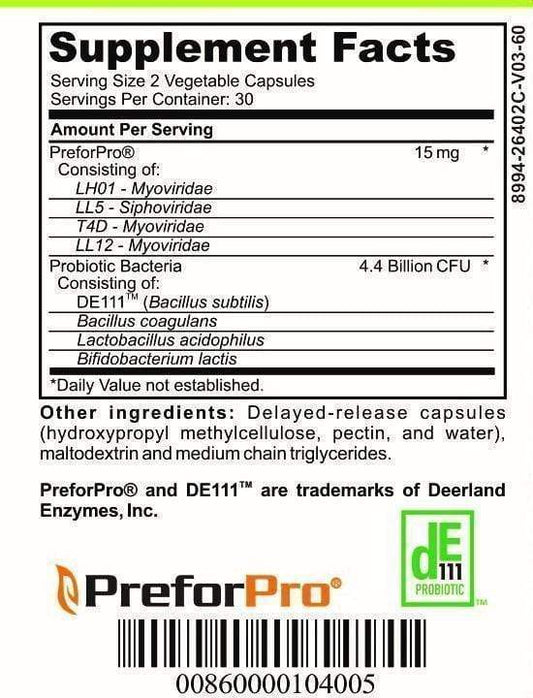

If you're looking for additional ways to save, consider exploring FODMAP digestive enzymes, which might offer some financial relief.

Alternative Ways to Save on Ozempic

Manufacturer Assistance Programs

Novo Nordisk, the maker of Ozempic, offers a Patient Assistance Program (PAP) for those who are uninsured and meet certain income requirements. This program can provide Ozempic at no cost if you qualify. Additionally, they offer an Ozempic Savings Card for those with private insurance, which can save you up to $150 per month.

Prescription Discount Cards

Prescription discount cards like SingleCare can help lower the cost of Ozempic. While you can't use these cards with Medicare Part D, they might offer better savings depending on your plan's formulary. It's worth checking different cards to see which offers the best discount.

State and Federal Assistance Programs

Programs like Medicare Extra Help can significantly reduce your medication costs if you have a limited income. To qualify for Extra Help in 2024, your annual income must be below $22,590 for an individual or $30,660 for a married couple. Many states also have their own assistance programs, so it's a good idea to check what's available in your area.

Finding the right assistance program can make a big difference in managing your medication costs. Don't hesitate to explore all your options.

Steps to Apply for Ozempic Coverage Under Medicare

Checking Your Plan’s Formulary

First, you need to check if Ozempic is on your Medicare plan’s formulary. A formulary is a list of medications that your plan covers. Each plan has its own formulary, so it's important to verify this information. You can usually find this list on your plan’s website or by calling their customer service.

Consulting with Your Healthcare Provider

Talk to your doctor about your need for Ozempic. They can provide medical documentation to support your case. This is especially important if your plan requires prior authorization. Your doctor can also suggest alternatives like low FODMAP collagen protein powder if Ozempic isn't covered.

Navigating the Appeals Process

If your initial request for coverage is denied, don’t give up. You have the right to appeal the decision. Here are the steps to follow:

- Request a Redetermination: Ask your plan to review its decision.

- Seek Reconsideration: If the redetermination is denied, you can request a reconsideration from an independent review entity.

- Administrative Law Judge Hearing: If reconsideration fails, you can ask for a hearing with an administrative law judge.

- Medicare Appeals Council: If the judge's decision is unfavorable, you can escalate the appeal to the Medicare Appeals Council.

- Federal Court: As a last resort, you can take your case to federal court.

Applying for Medicare coverage for Ozempic can be a complex process, but understanding each step can make it more manageable. Always consult with your healthcare provider and keep detailed records of all communications and documents.

Common Challenges and Solutions

Dealing with Coverage Denials

One of the biggest hurdles is getting a coverage denial for Ozempic. If your Medicare plan denies coverage, you can appeal the decision. Start by reviewing the denial letter to understand the reason. Then, gather any supporting documents from your healthcare provider that justify the need for Ozempic.

Understanding the Donut Hole

The Medicare Part D coverage gap, also known as the donut hole, can be confusing. During this phase, you might pay more out-of-pocket for your medications. To manage costs, consider using prescription discount cards or exploring manufacturer assistance programs.

Exploring Generic and Alternative Medications

If Ozempic is too costly, ask your doctor about generic or alternative medications. Sometimes, a different drug can be just as effective and more affordable. Additionally, incorporating lifestyle changes like diet and exercise, such as using a low FODMAP chocolate whey protein powder, can help manage your condition.

Facing common challenges in your health journey? You're not alone. Many people struggle with digestive issues, weight management, and finding the right supplements. But don't worry, we've got solutions tailored just for you. From low FODMAP meal plans to GLP-1 weight loss programs, our resources are designed to help you succeed. Ready to take the next step? Visit our website to explore all the ways we can support your health goals.

Conclusion

In conclusion, while getting a discount on Ozempic through Medicare can be challenging, it's not impossible. It's important to explore all available options, such as checking if your Medicare Part D plan covers Ozempic for diabetes treatment. Additionally, using prescription discount cards or applying for assistance programs can help lower the cost. Always consult with your healthcare provider to understand the best approach for your specific situation. Remember, managing your health is a priority, and there are resources out there to help you afford the medications you need.

Frequently Asked Questions

What is Ozempic?

Ozempic is a medicine that helps people with Type 2 diabetes control their blood sugar levels. It is an injection that you take once a week.

Does Medicare cover Ozempic?

Yes, Medicare Part D plans may cover Ozempic, but only if it's prescribed for Type 2 diabetes, not for weight loss.

How much does Ozempic cost with Medicare?

The cost of Ozempic can vary, but on average, it is around $2,300 per year with Medicare coverage. Costs depend on your specific plan and coverage details.

Can I get Ozempic for weight loss under Medicare?

No, Medicare does not cover Ozempic if it is prescribed only for weight loss. It only covers it for Type 2 diabetes treatment.

Are there other ways to save on Ozempic?

Yes, you can look into manufacturer assistance programs, prescription discount cards, and state or federal assistance programs to help lower the cost.

What should I do if my Medicare plan denies coverage for Ozempic?

If your plan denies coverage, you can check your plan’s formulary, consult your healthcare provider, and navigate the appeals process to try to get coverage.