Best Part D Plan for Ozempic: A Comprehensive Guide

Finding the best Medicare Part D plan for Ozempic can be tricky. Ozempic is a popular medication for treating Type 2 diabetes, but choosing the right plan can make a big difference in your costs. This guide will help you understand the top Part D plans available and what they offer so you can make the best choice for your needs.

Key Takeaways

- SilverScript is a top-rated Part D plan known for its comprehensive coverage and affordable pricing.

- Humana offers a variety of plans that can help cover the costs of Ozempic, making it a popular choice for many.

- Mutual of Omaha provides solid coverage options and has a good reputation for customer service.

- UnitedHealthcare is another strong option with extensive coverage and a wide network of pharmacies.

- Cigna's plans are also worth considering, offering good coverage and competitive pricing.

SilverScript

SilverScript is a popular Medicare Part D plan that offers comprehensive coverage for prescription medications, including Ozempic. This plan is known for its affordability and extensive pharmacy network. Here are some key features of SilverScript:

- Low Monthly Premiums: SilverScript offers plans with low monthly premiums, making it a budget-friendly option for many seniors.

- Wide Pharmacy Network: You can fill your prescriptions at numerous pharmacies nationwide, ensuring convenience and accessibility.

- Coverage for Generic and Brand-Name Drugs: SilverScript covers a wide range of medications, including both generic and brand-name drugs.

- No Deductible Options: Some SilverScript plans come with no deductible, meaning you start receiving benefits right away.

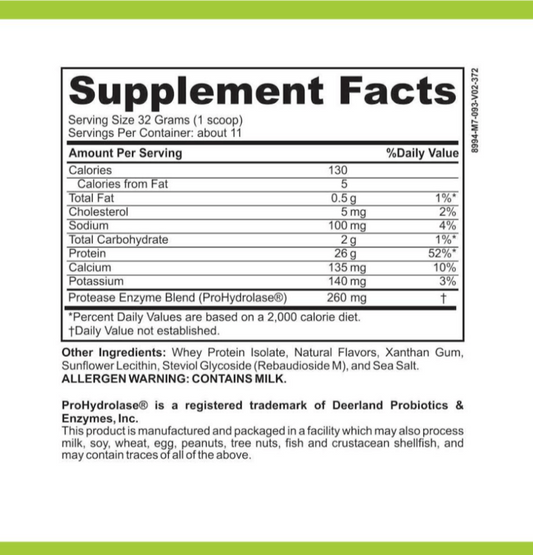

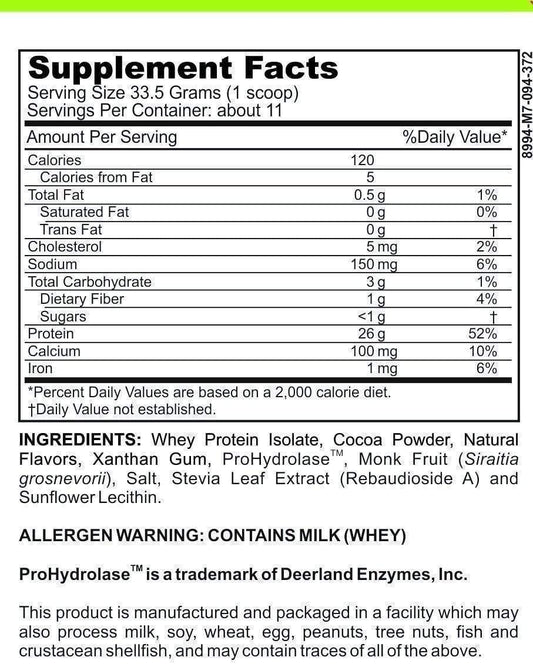

SilverScript is a solid choice for those looking for a reliable and affordable Medicare Part D plan. It provides excellent coverage for essential medications like Ozempic and even low FODMAP chocolate whey protein powder.

For those who need a plan that balances cost and coverage, SilverScript is worth considering.

Humana

Humana offers a variety of Medicare Part D plans, including the Humana Premier Rx Plan and the Humana Walmart Value Rx Plan. These plans are known for their comprehensive coverage and additional benefits. Here are some key features:

- $0 copays for 90-day supplies of Tier 1 and 2 medications at CenterWell Pharmacy®.

- $0 copays for Tier 6 Medicare drugs at preferred pharmacies.

- Preferred cost-sharing retail pharmacies include Walmart®, Sam’s Club®, Publix®, H-E-B®, Costco®, and Albertsons®.

- Additional gap coverage for Tier 1, 2, and 6 medications.

- Reduced deductibles in most regions.

Important Note

Humana's plans are available in all 50 states and Washington, D.C., but the pharmacy network may be limited in some areas. Make sure to check if your local pharmacy is included in the preferred network.

Pros and Cons

Pros:

- Multiple plans with additional gap coverage.

- Low-cost plans with $0 deductibles and copays for many drugs.

- Available nationwide.

Cons:

- Pharmacy network may be limited in some areas.

- Plans can be more expensive than competitors.

Humana's Premier Rx Plan is a solid choice for those who need extensive drug coverage and are willing to pay a bit more for the added benefits.

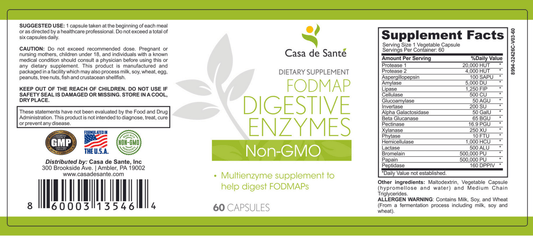

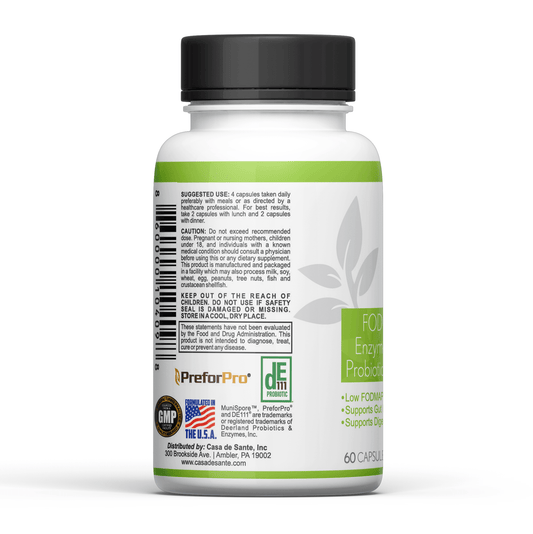

For those taking medications like Ozempic, it's crucial to check if your specific drugs are covered under the plan you choose. Additionally, if you are using FODMAP digestive enzymes, make sure they are included in the formulary to avoid unexpected costs.

Mutual of Omaha

Mutual of Omaha offers two main Medicare Part D plans: Rx Premier and Rx Plus. These plans are designed to cater to different medication needs and budgets.

Rx Premier Plan

The Rx Premier Plan is ideal for those who take several generic medications or mid-to-high-tier medications. It has an average monthly premium of $80.83 and a $349 deductible for all tiers. This plan provides a good balance between cost and coverage.

Rx Plus Plan

The Rx Plus Plan is perfect for individuals who take several brand-name medications. It offers excellent coverage with low copayments for generic drugs on other tiers. The average monthly premium for this plan is $80.91.

Network Pharmacies

Mutual of Omaha's preferred pharmacy network includes major chains like CVS, Target, Sam’s Club, and Walmart, as well as many regional drug stores. This wide network ensures that you can easily find a convenient location to fill your prescriptions.

Overall Review

Mutual of Omaha has been a trusted name in the insurance industry for many years. Their customer service is highly rated, making them a reliable choice for Medicare Part D plans. With options for various coverage levels, they can meet the needs of a wide range of individuals.

If you are looking for a dependable Medicare Part D plan with a broad network of pharmacies and good customer service, Mutual of Omaha is a solid choice.

Additionally, for those who are concerned about their overall health, including the intake of supplements like glutamine, Mutual of Omaha's plans can help manage medication costs effectively.

UnitedHealthcare

UnitedHealthcare is a top choice for Medicare Part D plans, especially if you value customer satisfaction. It has the highest average NCQA rating among major Medicare providers. Here are some key points to consider:

- High Ratings: UnitedHealthcare boasts an average rating of 3.9 out of 5 stars from the NCQA, which is the highest among the companies reviewed. This rating includes member satisfaction and plan quality metrics.

- Financial Strength: The company has an A+ (Superior) financial strength rating from AM Best, indicating a superior ability to meet ongoing insurance obligations.

- Plan Options: UnitedHealthcare offers a variety of plans, including the AARP MedicareRx Walgreens plan, which is ideal if you use generic drugs and have access to a Walgreens pharmacy. This plan features low premiums, $2 copays, and no deductible on preferred tier 1 drugs purchased from Walgreens.

- Nationwide Coverage: UnitedHealthcare provides coverage throughout the United States and in Washington, D.C.

- Extra Benefits: Some plans offer perks like free delivery on 90-day supplies, which can be a great convenience.

UnitedHealthcare is also a top pick for Medicare Advantage and Medicare Supplement (Medigap) plans, making it a versatile choice for various healthcare needs.

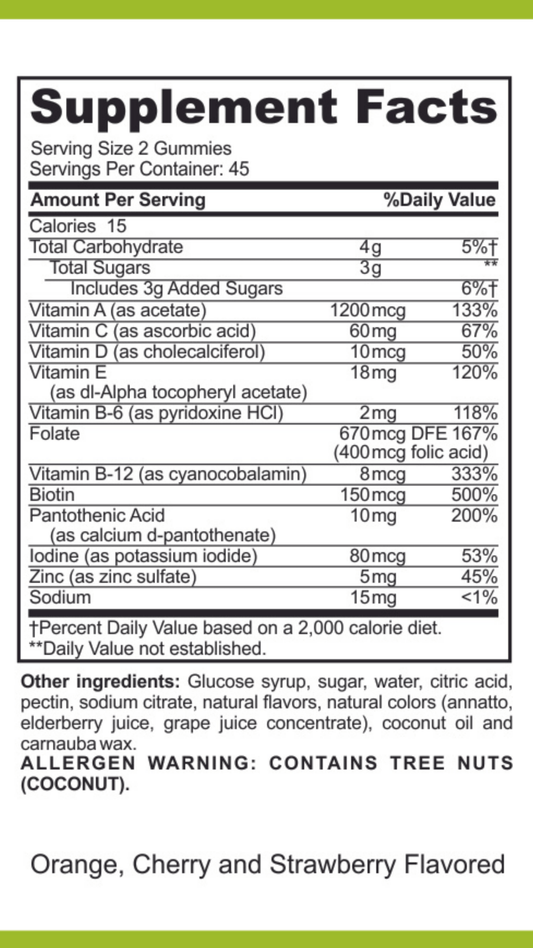

If you are looking for a reliable plan that covers your medications and offers additional benefits like free delivery, UnitedHealthcare is a strong contender. Just remember to check if your preferred pharmacy is in-network to maximize your savings. And don't forget to take your multivitamin to stay healthy!

Cigna

Cigna offers a variety of Medicare Part D plans that can be a good fit for those needing coverage for Ozempic. One of the standout features is the $0 copay for Tier 1 generic drugs available with all Cigna plans. This can be particularly beneficial if you are also taking other medications.

Pros

- $0 copays for Tier 1 generic drugs

- Above-average member experience ratings

- Free home delivery for 90-day supplies

Cons

- Higher prices for 2024 plans

- More drugs have coinsurance instead of copays

- Lowest copays may require mail-order for 90-day supplies

Additional Perks

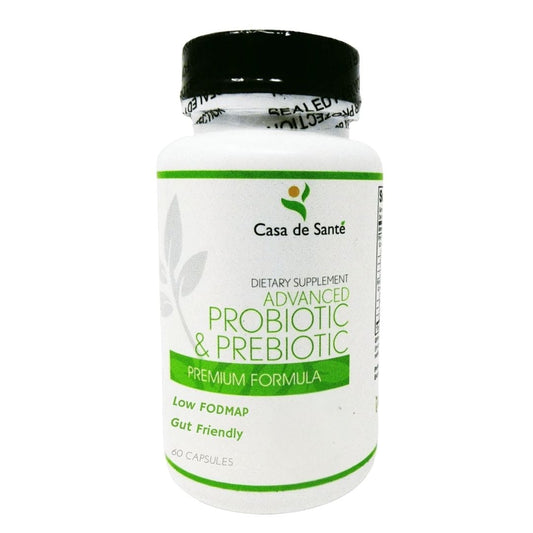

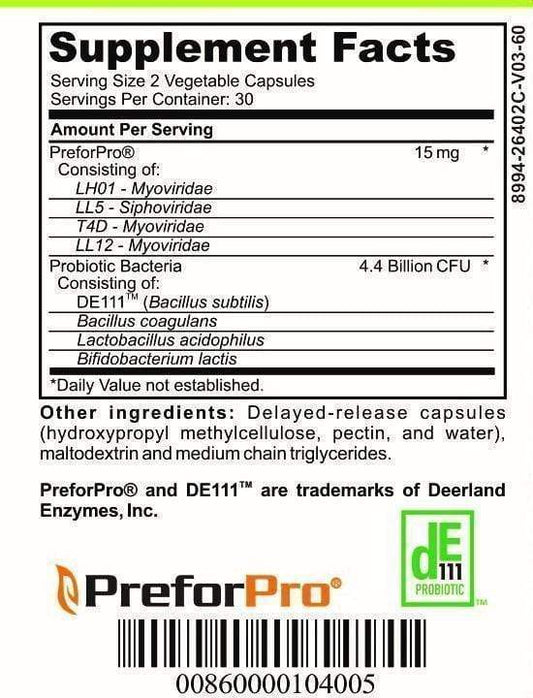

Cigna plans come with extra benefits like discounts on non-covered services such as LASIK and acupuncture. They also offer discounts on Gaiam yoga products. If you are looking for a low FODMAP probiotic, Cigna's plans might offer discounts on such items as well.

Cigna's plans are available in all 50 states, making it a versatile option for many. However, always check the specific costs for your medications, as formularies can differ.

Summary

Cigna's Medicare Part D plans are more expensive in 2024, but they still offer valuable benefits like $0 copays for Tier 1 generics and free home delivery for 90-day supplies. While the prices are higher, the added perks and above-average member experience ratings make it a strong contender.

Anthem MediBlue Rx Standard

The Anthem MediBlue Rx Standard plan is a solid choice for those who need reliable prescription drug coverage. This plan is ideal for individuals who take fewer medications.

Key Features

- Monthly Premium: $52 - $109

-

Annual Prescription Deductible:

- Tiers 1 and 2: $0

- Tiers 3-5: $545

- Copay Costs: Low copays for most generic drugs at preferred pharmacies

- Covered Drugs: Many brand-name and generic drugs

- Network Pharmacies: Nationwide, with over 65,000 pharmacies

- Preferred Cost-Sharing Pharmacies: Over 27,000 pharmacies, including major chains like CVS, Walmart, and Costco

Benefits

- Mail Order Option: Convenient for regular prescriptions

- Wide Network: Access to a large number of pharmacies across the country

- Low Copays: Affordable options for generic medications

Anthem MediBlue Rx Standard is a great option if you want a plan with a broad network and low copays for generic drugs.

Considerations

- Higher Deductible for Tiers 3-5: If you need medications in these tiers, be prepared for a higher deductible.

- Inositol Coverage: Check if inositol, a supplement often used for various health benefits, is covered under this plan.

This plan is not connected with or endorsed by the U.S. Government or the federal Medicare program. Always review the plan details and consult with a licensed agent to ensure it meets your needs.

Anthem MediBlue Rx Plus

The Anthem MediBlue Rx Plus plan is a solid choice for those who need extensive medication coverage. This plan is especially beneficial for individuals who take multiple brand-name drugs. It offers a wide range of covered medications, including both generics and brand names.

Key Features

- Monthly Premium: Ranges from $70 to $133

- Annual Prescription Deductible: $0 for all tiers

- Copay Costs: Low copays for most generic drugs at preferred pharmacies

- Network Pharmacies: Over 65,000 pharmacies nationwide, including 27,000+ preferred cost-sharing pharmacies

- Preferred Retail Chains: Includes Albertsons, CVS Pharmacy, Costco, Giant Eagle Pharmacy, Harris Teeter Pharmacy, H-E-B Pharmacy, Kinney Drugs, Kroger, Publix, Roundy's, Safeway, and Walmart

- Mail Order Option: Available for convenience

This plan is ideal for those who need a broad range of medications and prefer low copayments for generics. If you are taking psyllium or other specific medications, this plan's extensive network and coverage can be very beneficial.

Why Choose Anthem MediBlue Rx Plus?

- Comprehensive Coverage: Covers a wide range of medications, making it suitable for those with complex medication needs.

- Low Copayments: Especially for generic drugs, which can help manage out-of-pocket costs.

- Extensive Pharmacy Network: Access to a large number of pharmacies nationwide, including many preferred options for lower costs.

- Convenience: Mail order options make it easier to get your medications without frequent trips to the pharmacy.

Choosing the right Part D plan can make a significant difference in managing your healthcare costs and ensuring you have access to the medications you need. Anthem MediBlue Rx Plus offers a balanced mix of coverage, cost, and convenience.

Aetna

Aetna offers a variety of prescription drug plans that cater to different needs and budgets. Their plans are known for providing good value, especially when considering premiums and deductibles.

Key Features

- Low Premiums: Aetna's plans often come with lower premiums compared to other providers.

- Free Prescription Delivery: Enjoy the convenience of free home delivery for your medications.

- Coverage During the Gap Phase: The SilverScript Plus plan offers additional coverage during the Medicare donut hole.

Plan Options

Aetna provides three main SilverScript plans:

- SmartSaver Plan: This plan has an average monthly premium of $11.19 but comes with higher copays.

- SilverScript Plus Plan: With a premium of $103.51, this plan offers a $0 deductible and more $0 copays, even during the coverage gap.

- SilverScript Choice Plan: A middle-ground option between the SmartSaver and Plus plans.

Pros and Cons

Pros

- Best value for premiums and deductibles.

- Free prescription home delivery.

- Additional drug coverage during the Medicare donut hole.

Cons

- Only one plan covers the Medicare donut hole period.

- Higher copays for non-generic medications (tiers 3-5).

Aetna's plans are a solid choice for those looking for affordable premiums and comprehensive coverage, especially if you need extra support during the coverage gap.

WellCare

WellCare offers some of the most affordable Medicare Part D plans available in 2024. In certain areas, you can even find plans with a $0 premium. This makes WellCare a great option for those looking to save on their prescription drug costs.

Key Features

- Low Premiums: WellCare is known for its low-cost plans, making it accessible for many seniors.

- Improved Quality Ratings: The quality ratings for WellCare's plans have significantly improved over the years.

- $0 Deductible Options: Some plans come with a $0 deductible, which can be a big plus for those on a tight budget.

Member Experience

WellCare has an above-average rating for member experience, scoring 4.0 out of 5 stars. This rating reflects the overall satisfaction of members with their drug plans.

Out-of-Pocket Costs

The out-of-pocket costs for WellCare plans can vary, but they generally offer competitive copays, coinsurance, and deductibles compared to other providers.

Additional Benefits

- Foreign Language Support: WellCare provides call center support in multiple languages, making it easier for non-English speakers to get help.

- TTY Availability: For those with hearing impairments, TTY services are available.

If you're looking for a plan that balances cost and quality, WellCare is worth considering. Plus, if you're into health supplements, you might want to check out low FODMAP collagen protein powder to complement your wellness routine.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) offers a variety of Medicare Part D plans that can help cover the cost of Ozempic. These plans are known for their extensive network and reliable customer service. Here are some key points to consider:

- Coverage Options: BCBS provides multiple plans with different levels of coverage, so you can choose one that fits your needs.

- Cost: The cost of the plans can vary, but they often include competitive premiums and copays.

- Network: BCBS has a large network of pharmacies, making it easier to get your prescriptions filled.

- Customer Service: Known for their excellent customer service, BCBS can help you navigate your plan and answer any questions you may have.

Important Note

When considering a BCBS plan, it's essential to check if your specific medications, like Ozempic and berberine, are covered. This can help you avoid unexpected costs.

Summary Table

| Feature | Details |

|---|---|

| Coverage Options | Multiple plans with varying coverage levels |

| Cost | Competitive premiums and copays |

| Network | Large network of pharmacies |

| Customer Service | Excellent support and assistance |

Choosing the right BCBS plan can make managing your medications easier and more affordable.

Blue Cross Blue Shield offers a range of health insurance plans to meet your needs. Whether you're looking for individual coverage or a family plan, they have options that can help you stay healthy and save money. Don't miss out on the benefits you deserve. Visit our website to learn more and find the perfect plan for you.

Conclusion

Choosing the best Medicare Part D plan for Ozempic can be tricky, but it's important to find the right one for your needs. Remember, not all plans are the same, and what works for one person might not work for another. Take your time to compare different plans, look at what they cover, and think about your own health needs. By doing this, you can make sure you get the best coverage for your medication. Always talk to your doctor and a Medicare expert if you have questions. They can help you understand your options and make the best choice for your health.

Frequently Asked Questions

What is a Medicare Part D plan?

A Medicare Part D plan helps cover the cost of prescription drugs. These plans are offered by private insurance companies and can be added to Original Medicare or included in a Medicare Advantage plan.

Does Medicare cover Ozempic?

Yes, Medicare covers Ozempic, but only if you are using it to treat Type 2 diabetes. Medicare does not cover Ozempic for weight loss.

What are the best Medicare Part D plans for Ozempic?

Some of the top Medicare Part D plans that cover Ozempic include SilverScript, Humana, Mutual of Omaha, UnitedHealthcare, and Cigna.

How do I find out if my Medicare plan covers Ozempic?

You can check your plan's formulary, which is a list of covered drugs. You can also contact your insurance provider for more details.

Are there any restrictions for Ozempic coverage under Medicare?

Yes, Medicare will only cover Ozempic if it is prescribed for treating Type 2 diabetes. It will not cover the drug if it is used solely for weight loss.

Can I switch my Medicare Part D plan to get better coverage for Ozempic?

Yes, you can switch your Medicare Part D plan during the annual open enrollment period from October 15 to December 7. Make sure to compare different plans to find one that best meets your needs.