FSA HSA Letter of Medical Necessity Strafford: Guide to Approval & Local Support Services

Managing healthcare expenses can feel overwhelming but flexible spending accounts (FSA) and health savings accounts (HSA) offer real relief. If you’re in Strafford and want to maximize your benefits you’ve probably heard about the importance of a Letter of Medical Necessity. This simple document can make a big difference in what expenses your FSA or HSA will cover.

I know how confusing it can be to figure out exactly what you need for reimbursement. That’s why I’m here to break down what a Letter of Medical Necessity is and how it works specifically for Strafford residents. With the right information you’ll feel confident using your FSA or HSA for the care you need.

Understanding FSA and HSA Accounts

Flexible spending accounts (FSA) and health savings accounts (HSA) both offer tax-advantaged ways for me to pay for eligible healthcare expenses in Strafford. Each account type uses pre-tax contributions to reduce my taxable income, but they work differently.

FSAs come as employer-sponsored benefit plans, and I can use them for qualified medical, dental, or vision costs such as copays, prescriptions, and over-the-counter medications. FSAs usually require me to spend funds within the plan year, with limited carryover options.

HSAs apply when I enroll in a high-deductible health plan (HDHP). Contributions stay in my account year after year since unused funds roll over and accumulate interest or investment gains. I can use HSA funds for a wide range of IRS-approved healthcare expenses—including deductibles, prescriptions, and medical devices.

Common features of both accounts include their requirement for eligible expenses. The IRS defines eligible expenses in Publication 502, which lists examples like lab fees, therapy, and diagnostic devices.

When certain products or services aren’t automatically classified as eligible, providers may request a Letter of Medical Necessity. This documentation confirms that a healthcare product or service directly treats, diagnoses, or prevents a specific medical condition, triggering reimbursement eligibility from my FSA or HSA.

Strafford residents benefit from understanding these account basics, ensuring I get the maximum tax advantages and reimbursement for necessary healthcare costs.

What Is a Letter of Medical Necessity?

A Letter of Medical Necessity verifies that a specific product or service is essential for treating a diagnosed condition. I use this letter to support requests for FSA or HSA reimbursement when an expense isn’t automatically categorized as eligible.

Key Elements of a Valid Letter

A valid Letter of Medical Necessity always contains specific essential elements:

- Provider Information: My letter includes my healthcare provider’s full name, credentials, and contact details.

- Patient Identification: I include my name, date of birth, and relevant identification.

- Diagnosis: My letter clearly states the diagnosis or medical condition that requires the recommended product or service.

- Duration: I specify the length of time the treatment is medically necessary, such as “ongoing,” “three months,” or a date range.

- Detailed Recommendation: The document details the exact product or service, including quantity or frequency if needed, such as “weekly physical therapy.”

- Medical Justification: My provider explains why over-the-counter or alternative solutions aren’t sufficient for my care.

- Provider Signature and Date: My provider’s signature and the current date complete and validate the letter.

Common Situations Requiring a Letter

Several medical scenarios prompt the need for a Letter of Medical Necessity:

- Specialty Treatments: Services like occupational therapy or chiropractic care often require documentation.

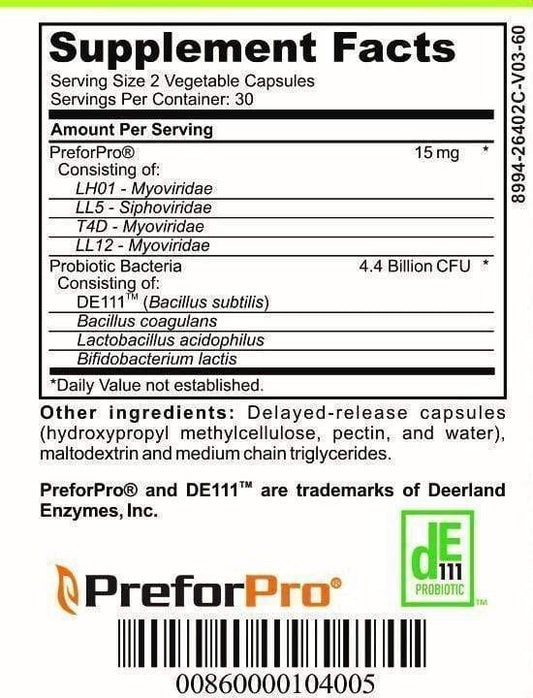

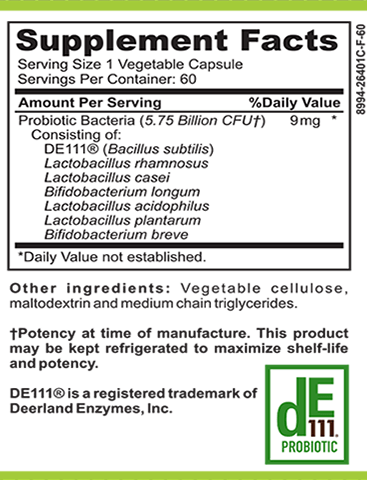

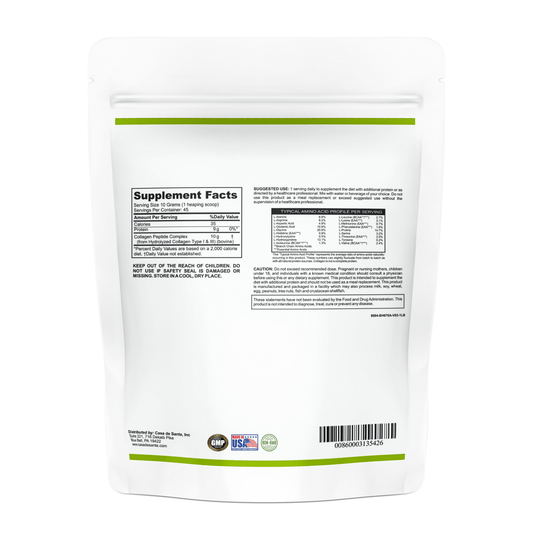

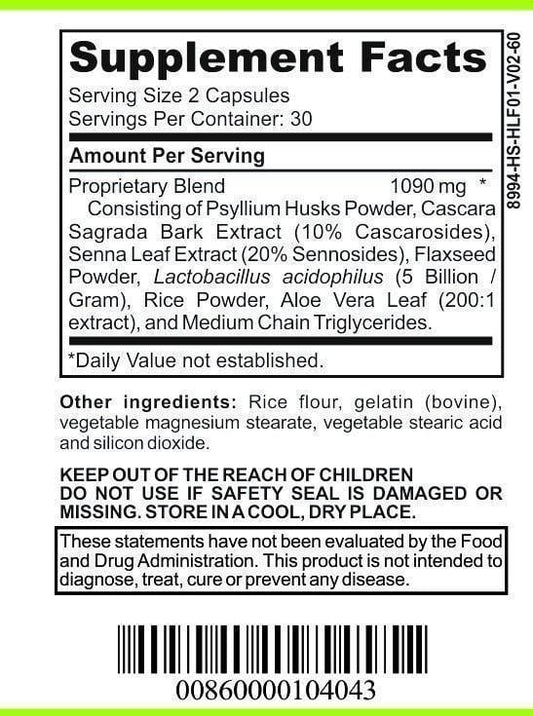

- Nutritional Supplements: When I need supplements beyond ordinary dietary use for a diagnosed condition, the letter justifies reimbursement.

- Medical Equipment: Requests for items such as CPAP machines, orthopedic devices, or breast pumps frequently demand supporting documentation.

- Therapies and Counseling: Mental health services and some alternative therapies, like acupuncture, usually require a written explanation from my provider.

- School or Workplace Accommodations: Adaptations like standing desks or adaptive chairs tied to specific conditions often call for provider justification.

Insurers and account administrators refer to this letter to verify the necessity before approving FSA or HSA reimbursements.

The Role of Strafford in FSA HSA Letters of Medical Necessity

Strafford provides specialized support for residents using FSAs or HSAs, particularly when a Letter of Medical Necessity is required. I streamline the process to help users meet administrator requirements and maximize eligible reimbursements.

Services Offered by Strafford

- Letter Preparation Support

I assist clients with preparing Letters of Medical Necessity by coordinating between patients and licensed healthcare providers.

- Document Review

I review submissions to check all IRS-required elements—diagnosis, medical justification, treatment duration, and provider identification—are present.

- Template and Guidance

I offer standardized letter templates and clear guidelines, helping residents avoid common omissions.

- Provider Liaison

I communicate directly with healthcare professionals in Strafford to ensure letters accurately reflect medical need for FSA or HSA-eligible products or services.

Advantages of Using Strafford

- Local Expertise

I understand Strafford's healthcare landscape, including local practitioners and insurance carriers, which speeds up provider responses and document accuracy.

- Faster Reimbursement

I reduce denial risks by aligning documentation with IRS guidelines and reimbursement policies specific to major FSA and HSA administrators serving Strafford.

- Personalized Service

I tailor document assistance to individual needs, whether for specific chronic conditions or unique medical equipment requests.

- Compliance Assurance

I ensure Letters of Medical Necessity align with Strafford’s regulatory standards and IRS rules, helping residents avoid delays or audits in their benefit accounts.

How to Obtain a Letter of Medical Necessity Through Strafford

Obtaining a Letter of Medical Necessity through Strafford follows a streamlined process designed to meet FSA or HSA requirements. I leverage Strafford's expert support to complete every required step and meet documentation standards.

Step-by-Step Process

I begin by scheduling a consultation with my healthcare provider in Strafford to discuss my specific medical needs and account eligibility. After assessing the treatment or item, my provider outlines medical reasons, referencing diagnosis codes and clinical recommendations. I then submit my provider’s draft to Strafford’s FSA/HSA support team, which reviews the letter for IRS compliance and local administrator requirements. If necessary, Strafford edits or amends the document, using their standardized template to ensure all essential elements—such as provider credentials, diagnosis, and treatment duration—are present. Once finalized and signed by my licensed provider, I submit the letter with related receipts to my FSA/HSA plan administrator for reimbursement.

Required Documentation

I gather the following documents to secure a correctly validated Letter of Medical Necessity in Strafford:

- Current prescription and provider notes: These detail diagnoses and the medical need for the treatment, such as durable medical equipment, specialized therapies, or supplements.

- Strafford-specific medical necessity template: I use this to guarantee all IRS-required details and provider information appear in the letter.

- Itemized bills or receipts: These list costs and correlate directly to the requested FSA or HSA reimbursement.

- Insurance explanation of benefits (EOB): I include this for procedures not fully covered or denied by my primary plan.

- Provider credentials and contact information: These identify the licensed Strafford professional issuing the recommendation.

I keep digital copies of all documentation, as Strafford’s administrative staff may request supporting materials during the review for compliance.

Tips for Ensuring Approval of Your FSA HSA Expenses

- Gather Complete Documentation

I always collect all relevant documents for each FSA or HSA expense, including itemized bills, Letter of Medical Necessity, prescriptions, and provider credentials, before submitting my claim.

- Use Strafford-Approved Templates

I submit Letters of Medical Necessity using the specific Strafford-compliant template to match IRS requirements and speed up administrator review.

- List Specific Diagnoses and Recommendations

I make sure my provider states the diagnosis and explicitly details the recommended treatment or products, since vague justifications often delay or prevent approval.

- Confirm Provider Signatures and Dates

I check that each letter or supporting document contains the provider’s signature and date, since unsigned or undated forms typically result in rejections.

- Retain Digital Records

I store digital versions of all submitted documents, as this provides quick access when account administrators request supporting information.

- Review Plan-Specific Guidelines

I always review my FSA or HSA plan’s guidelines for eligible expenses, because plans may differ and some services require stricter documentation.

- Follow Up With Administrators

I contact my FSA or HSA administrator for claim status when I haven't received feedback within expected timelines, which helps resolve review issues faster.

- Keep Records of Communication

I document all communication with healthcare providers and benefit administrators, including dates and summary notes, as thorough records prevent misunderstandings and support appeals if a claim is denied.

- Request Professional Support

I consult local Strafford FSA/HSA support services for document review and submission guidance, as expert advice minimizes mistakes and improves approval rates.

Conclusion

Navigating FSA and HSA requirements in Strafford doesn’t have to feel overwhelming. With the right support and a clear understanding of what’s needed for a Letter of Medical Necessity, I’ve found it much easier to get my eligible expenses approved and reimbursed.

Taking the time to gather proper documentation and using local resources has made a big difference for me. If you’re looking to maximize your healthcare benefits, don’t hesitate to reach out for help—Strafford’s expertise can make the process smoother and more efficient.