FSA HSA Letter of Medical Necessity Fort Washington: How to Qualify and Maximize Benefits

Navigating the world of health savings accounts can feel overwhelming especially when it comes to using your FSA or HSA for more than just the basics. I know how important it is to make every dollar count and that’s where a Letter of Medical Necessity comes in. If you’re in Fort Washington and wondering how this letter can help you unlock extra benefits you’re in the right place.

I’ve learned that with the right documentation you can get coverage for treatments and products your doctor recommends even if they aren’t typically included. Understanding what a Letter of Medical Necessity is and how to get one can make a real difference in your healthcare experience and your wallet.

Understanding FSA and HSA Accounts

Flexible spending accounts (FSAs) and health savings accounts (HSAs) both let me set aside pre-tax dollars for qualifying medical expenses. FSAs commonly connect to employer-sponsored health plans and require me to use funds within a calendar year or risk forfeiture. HSAs pair with high-deductible health plans, and my unused balances roll over from year to year, letting me grow the account over time.

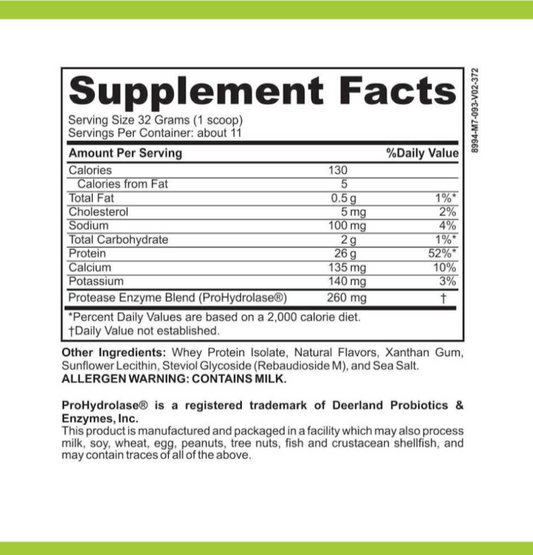

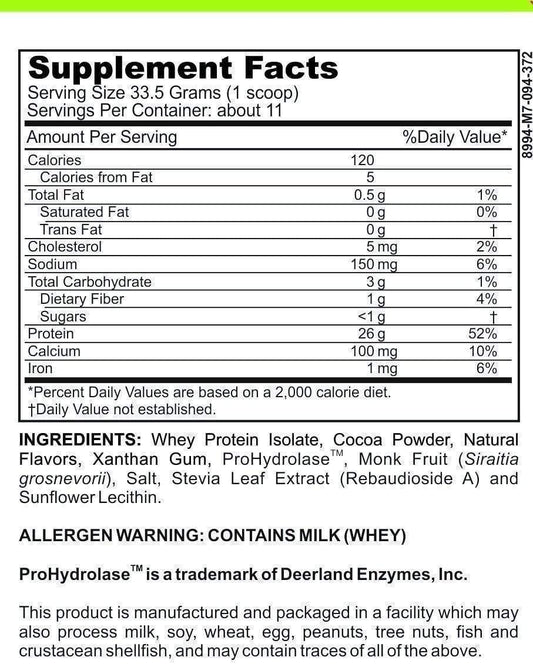

Eligible expenses that I cover with FSA and HSA funds include copays, prescription drugs, and medical devices like glucose meters. Some additional treatments or wellness products in Fort Washington, such as alternative therapies or specialized supplements, require a Letter of Medical Necessity from my healthcare provider before reimbursement.

Contribution limits differ for each account type. The IRS sets the 2024 limit for individual HSAs at $4,150 and FSAs at $3,200. Employers may also contribute to these accounts, but the total can't exceed the annual IRS limits.

Tax advantages provide savings. My FSA and HSA contributions lower taxable income, and qualified withdrawals remain tax free. If I use my accounts for ineligible expenses, I face taxes and possible penalties, so I confirm each purchase meets requirements.

Proper documentation stays essential, as administrators in Fort Washington may request receipts or a Letter of Medical Necessity for items not typically covered. This ensures my claims process smoothly and that I maximize the value of my FSA or HSA for needed healthcare.

What Is a Letter of Medical Necessity?

A Letter of Medical Necessity validates that a specific product or service is essential for treating a health condition. I use this document to support my requests for FSA or HSA reimbursements in Fort Washington when claims extend beyond routine medical expenses.

Key Elements of a Letter of Medical Necessity

A Letter of Medical Necessity contains specific details that qualify an expense for FSA or HSA reimbursement:

- Statement of Necessity: My healthcare provider explains the medical reason for the recommended treatment or item.

- Patient Information: The letter lists my full legal name, date of birth, and diagnosis.

- Prescribed Treatment: My provider identifies the exact product, procedure, or service, like orthotics, medical foods, or therapy sessions.

- Duration of Use: The provider specifies how long I need the treatment or service, such as “ongoing” or “for 12 months.”

- Date and Signature: My healthcare practitioner dates and signs the letter, providing their credentials and contact information.

Common Situations Requiring a Letter

- Over-the-Counter Medications: I need a letter for items like allergy medicine or heartburn relief when not prescribed.

- Alternative Treatments: FSA and HSA rules often require a letter for acupuncture, chiropractic visits, or massage therapy.

- Medical Supplies: Specialized supports, orthotic inserts, or continuous glucose monitors often need documentation.

- Educational Therapies: When paying for speech, occupational, or behavioral therapy for developmental conditions, I provide a supporting letter.

- Home Modifications: Costs for ramps or bathroom improvements for mobility impairments usually require written justification.

The Process for Obtaining a Letter of Medical Necessity in Fort Washington

Navigating FSA and HSA coverage for advanced healthcare needs in Fort Washington relies on getting a valid Letter of Medical Necessity. I streamline the process by focusing on recognized healthcare professionals and steps that align with medical, administrative, and IRS documentation standards.

Who Can Write the Letter?

Licensed healthcare providers in Fort Washington—including medical doctors, nurse practitioners, physician assistants, and specialists—authorize Letters of Medical Necessity. Providers must have direct knowledge of my medical history and evaluate my specific health condition related to the treatment or product.

Steps to Request and Submit the Letter

- Schedule a Medical Assessment

I contact my local provider and arrange a medical evaluation to discuss the specific health necessity for the FSA or HSA-eligible item.

- Provide Documentation

I gather relevant documents, such as treatment plans and medical records, before my appointment to ensure accuracy.

- Request the Letter During the Visit

I ask my provider to draft an official Letter of Medical Necessity, including details like diagnosis, recommended treatment, usage timeline, and the provider’s license information.

- Review for Completeness

I verify the letter contains all mandatory elements: my name, diagnosis, justification for the product, and the provider’s signature.

- Submit to FSA or HSA Administrator

I submit the letter—digitally or in print—to my account administrator along with my reimbursement claim.

- Retain Copies for Records

I keep both digital and paper copies for my personal records, supporting any future IRS or administrator audits.

Tips for a Successful FSA HSA Reimbursement in Fort Washington

Navigating FSA and HSA reimbursements in Fort Washington streamlines healthcare spending when following best practices. Clear documentation and collaboration with healthcare providers increase approval rates for a Letter of Medical Necessity.

Avoiding Common Mistakes

Maintaining precise records prevents claim delays in Fort Washington. Submitting incomplete documentation, omitting details like the provider’s signature or diagnosis, or using unauthorized treatments leads to denials. Reviewing each Letter of Medical Necessity for full patient information, treatment purpose, and exact duration improves claim acceptance. Using provider-recommended products only, as seen in categories like exercise equipment, allergy treatments, or home mobility aids, meets IRS requirements for eligible expenses.

Working With Healthcare Providers

Collaborating with Fort Washington healthcare professionals increases reimbursement success for FSA and HSA accounts. Contacting a licensed provider, like a board-certified physician or nurse practitioner, ensures each letter meets insurer standards. Communicating treatment goals and providing context about insurance needs during visits leads to more accurate and thorough documentation. Following up after appointments and requesting clarifications about recommended products for conditions like diabetes or chronic pain helps maintain compliant records.

Why the FSA HSA Letter of Medical Necessity Matters in Fort Washington

A Letter of Medical Necessity directly determines my ability to get FSA or HSA coverage for non-standard healthcare items in Fort Washington. Local FSA and HSA administrators require this document for items not automatically approved by the IRS, including over-the-counter medications, adaptive medical supplies, and therapeutic services beyond typical copays. Without it, eligible expenses like physical therapy equipment, special dietary products, and occupational therapy for dependents often get denied reimbursement.

Local medical providers follow Washington health regulations and regional insurance requirements, which frequently change. In Fort Washington, strict adherence to these protocols means my FSA or HSA claims process depends on accurate, detailed letters with the right clinical language. This extra step lets me justify treatments specifically necessary for my medical conditions, meeting approval standards from account administrators.

Tax savings also depend on the letter’s acceptance. When I submit a complete Letter of Medical Necessity, I support my qualified expense claims, lowering my out-of-pocket costs and increasing pre-tax savings. If administrators reject the letter, my ability to maximize FSA or HSA funds drops sharply.

Local clinics and health systems in Fort Washington recognize how essential this documentation is in expanding my use of available financial resources for care. Engaging with area healthcare professionals who understand the nuances of local insurance guidelines increases the likelihood that my claims will meet both IRS and plan-specific criteria, unlocking the full advantages these accounts offer.

Conclusion

Navigating FSA and HSA requirements in Fort Washington doesn't have to feel overwhelming. With the right approach and a well-prepared Letter of Medical Necessity, I can make the most of my healthcare dollars while ensuring I get the care and products I need.

I always recommend partnering with trusted local healthcare providers who understand the process. Their expertise helps me avoid common pitfalls and gives me confidence that my claims will be processed smoothly. Taking these steps means I can focus more on my health and less on paperwork.