FSA HSA Letter of Medical Necessity Flourtown: Guide to Easy Reimbursement and Savings

Managing healthcare expenses can feel overwhelming but using an FSA or HSA makes it a lot easier. If you're in Flourtown and want to get the most from your benefits you might've heard about a Letter of Medical Necessity. It's a key document that could unlock savings on treatments and products your insurance might not cover.

I've learned that understanding how and when to use this letter can make a real difference. Whether you're buying medical supplies or seeking specialized care knowing the basics puts you in control of your health spending. Let's break down what an FSA or HSA Letter of Medical Necessity means for you in Flourtown and why it matters.

Understanding FSA and HSA Accounts

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are tax-advantaged accounts for medical expenses. I use these accounts to pay for qualified medical products and services in Flourtown and beyond. Employers usually offer FSAs, while HSAs are available only with high-deductible health plans (HDHPs).

FSAs let me contribute pretax earnings up to $3,050 per year (IRS, 2024), with any unused funds either limited in rollover or forfeited, based on my employer's rules. HSAs allow up to $4,150 for individuals or $8,300 for families in 2024 (IRS), with funds rolling over year to year and offering investment growth.

My FSA and HSA accounts cover a list of eligible items, for example, prescription medications, diagnostic devices, and certain medical procedures. Some non-standard treatments and over-the-counter products, like specific supplements or therapies, need a Letter of Medical Necessity for reimbursement. I provide this documentation so my account administrator can process these specialized claims in Flourtown.

What Is a Letter of Medical Necessity?

A Letter of Medical Necessity documents a healthcare provider's explanation stating that a treatment or product is required to diagnose, treat, or prevent a specific medical condition. I use this letter when FSA or HSA funds must reimburse items not generally covered by insurance, such as certain over-the-counter supplies or alternative therapies in Flourtown.

Key Components of a Letter of Medical Necessity

Effective Letters of Medical Necessity include several elements:

- Identifying patient details, like name and date of birth, to link the letter to a specific individual.

- Stating the exact diagnosis, such as type 2 diabetes or chronic migraines, to establish the medical basis.

- Describing the prescribed service or product, including examples like specialized orthotics or continuous glucose monitors.

- Listing the healthcare provider’s credentials, signature, and contact information for validation and future reference.

- Adding the anticipated treatment duration, like “one year” or “as ongoing management,” tied to the patient’s care plan.

Why These Letters Are Important for FSA and HSA

A Letter of Medical Necessity supports claims for FSA and HSA reimbursements when expenses aren’t automatically approved. I submit this letter to show that a dermatologist-recommended sunscreen or a certain type of therapy meets IRS-qualified medical expense guidelines. Without documented necessity, administrators in Flourtown deny those claims—even for recurring costs essential to chronic condition management. This letter helps me maximize my tax-advantaged savings and ensures compliance with federal requirements.

The Process of Obtaining a Letter of Medical Necessity in Flourtown

Obtaining a Letter of Medical Necessity in Flourtown involves a specific set of actions that connect patients, healthcare providers, and FSA or HSA plan administrators. Flourtown practitioners and clinics follow established documentation protocols to ensure compliance with IRS and plan requirements.

Steps to Request a Letter from Your Healthcare Provider

- Contact scheduling with your provider

I schedule an appointment with my healthcare provider familiar with my medical history. Appointment requests typically clarify the purpose relates to a medical necessity letter for FSA or HSA plan purposes.

- Documentation preparation

I bring supporting documents, such as prescription records, past diagnoses, or notes about prior failed treatments. Providers in Flourtown often request prior medical records for reference.

- Provider letter drafting

I work with my provider to ensure the letter clearly outlines my medical diagnosis, recommended treatments or products, necessity reasoning, and duration. Providers reference IRS guidance for terminology and completeness.

- Letter format verification

I check that the letter includes the provider’s credentials (e.g., MD, DO, NP), date, treatment start and end dates, and their contact information, since rejected claims often lack these elements.

- Submission to plan administrator

I submit the signed letter directly to the FSA or HSA plan administrator, attached to my claim documentation. Submission may occur by mail, email, or secure digital platforms, depending on the administrator’s policy.

Common Challenges and How to Overcome Them

- Incomplete letters

Providers sometimes omit details like diagnosis codes or treatment duration, resulting in claim denial. I provide a checklist to my provider to ensure all required details are included.

- Administrative delays

Letter processing or provider turnaround may take several days or weeks. I follow up proactively and request electronic delivery to expedite submission.

- Insurance misunderstanding

FSA or HSA administrators may reject letters not matching their specific requirements. I contact my benefits administrator beforehand to confirm acceptable formats and supporting details.

- Unclear necessity reasoning

Letters lacking a clearly stated medical necessity for the product or treatment can hinder approval. I ask my provider to use direct language, linking my diagnosis to the requested item using plan-specific terminology.

- Ongoing conditions

Providers sometimes write single-use letters for chronic needs, like CPAP supplies or orthotics. I request a duration covering the full treatment period or annual resubmission instructions.

Securing a compliant Letter of Medical Necessity in Flourtown relies on coordination between patient, provider, and plan rules, emphasizing communication and documentation precision.

Eligible Expenses Covered by FSA and HSA with a Letter of Medical Necessity

Eligible expenses with an FSA or HSA expand when I present a valid Letter of Medical Necessity. Local residents in Flourtown can claim reimbursement for specific products and services if their healthcare provider certifies the medical need.

Examples of Qualifying Products and Services

Qualifying products and services for FSA and HSA reimbursement with a Letter of Medical Necessity include a broad range of medically required items:

- Over-the-counter medications: Allergy treatments, pain relievers, or digestive aids prescribed for ongoing medical issues

- Durable medical equipment: Wheelchairs, crutches, feeding devices, or CPAP machines required for specific diagnoses

- Specialized therapies: Physical therapy, occupational therapy, or chiropractic adjustments not fully covered by standard insurance

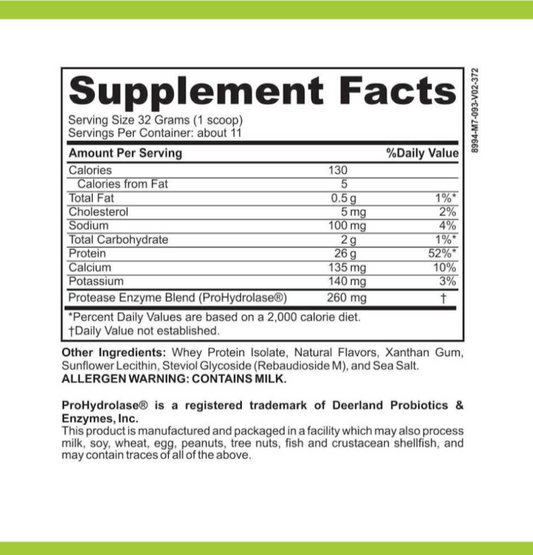

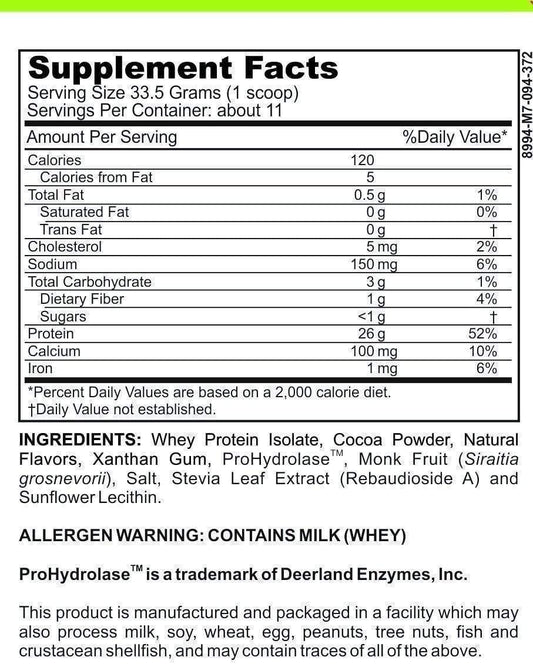

- Nutritional supplements: Vitamins or minerals prescribed by a physician for a diagnosed deficiency

- Weight-loss programs: Structured plans to treat obesity or related conditions after provider recommendation

- Psychotherapy and counseling: Mental health sessions exceeding insurance limits or with out-of-network specialists

- Dental and vision care: Orthodontics, prescription eyeglasses, or contact lenses with documented medical justification

Each item or service on this list may need detailed provider support and precise symptom or diagnosis documentation per IRS guidelines.

Local Providers in Flourtown

Flourtown offers access to several medical professionals familiar with the Letter of Medical Necessity process:

- Primary care clinics: Flourtown Family Medicine, Chestnut Hill Internal Medicine

- Specialty practices: Flourtown Physical Therapy, Visionworks Flourtown, Flourtown Dental Group

- Pharmacies and medical supply stores: Flourtown Pharmacy, Giant Pharmacy

I contact these local providers to discuss my medical needs, obtain documentation, and streamline my claims for FSA and HSA reimbursement. These offices maintain experience with detailed forms and insurance communications common to the Flourtown area.

Tips for Submitting Your Letter of Medical Necessity

Submitting a complete and precise Letter of Medical Necessity streamlines your FSA or HSA claim in Flourtown. I focus on accuracy and organization when preparing my documentation for reimbursement.

Ensuring a Smooth Reimbursement Process

I verify that my Letter of Medical Necessity matches the requirements of my FSA or HSA administrator in Flourtown. Specific elements include patient name, provider credentials, diagnosis, description of the treatment or product, duration, and provider signature. I check that my provider uses clear, specific medical terminology and attaches any relevant supporting documentation like prescriptions or clinical notes. I submit my claim forms and the letter together, if possible, and keep digital copies for my records in case the administrator requests further information. Responses to requests for additional details often move faster if I supply supplemental documentation—examples include appointment notes, itemized receipts, or a physician’s summary.

Maintaining Proper Documentation

I maintain organized records of every step in the process. My FSA or HSA claims file contains the original Letter of Medical Necessity, correspondence with providers, receipts, and administrator communications. I regularly update this file, especially if treatments are ongoing or I need renewals each plan year. For IRS compliance, I retain these documents for at least three years following reimbursement. If administrators in Flourtown request periodic verification or audits, I quickly provide accurate, complete records from my file to prevent delays or denials.

Conclusion

Navigating FSA and HSA requirements in Flourtown doesn't have to be overwhelming. With a clear understanding of the Letter of Medical Necessity and a proactive approach to documentation, I've found that managing healthcare expenses gets much easier.

By staying organized and working closely with my healthcare provider, I can take full advantage of my benefits and ensure my claims are processed smoothly. Taking these steps has helped me make the most of my tax-advantaged accounts and keep my health spending on track.