How Do I Get Ozempic if My Insurance Doesn't Cover It?

Getting your hands on Ozempic can be tough if your insurance doesn't cover it. Ozempic is a medication often prescribed for diabetes, but it can also help with weight loss. If your insurance says no, there are ways to still get it without breaking the bank. This article will guide you through different options to make Ozempic more affordable.

Key Takeaways

- Understanding Ozempic's uses and side effects is crucial before seeking it without insurance.

- Alternative insurance options, like switching plans or using a family member's insurance, can help cover Ozempic.

- Financial assistance programs from Novo Nordisk and discount cards can significantly reduce the cost.

- Prior authorization and appeals processes can sometimes get insurance to cover Ozempic even if initially denied.

- Exploring cost-saving strategies, such as using online coupons and finding affordable pharmacies, can make Ozempic more accessible.

Understanding Ozempic and Its Uses

What is Ozempic?

Ozempic is a medication primarily used to manage blood sugar levels in people with type 2 diabetes. It belongs to a class of drugs known as GLP-1 receptor agonists, which help the body release insulin when blood sugar levels are high. Ozempic is not insulin, but it helps your body use its own insulin better.

FDA Approval and Off-Label Use

The FDA has approved Ozempic for treating type 2 diabetes. However, some doctors prescribe it off-label for weight loss. Off-label means using the drug for something other than what it was officially approved for. While this can be effective, insurance companies might not cover off-label uses.

Common Side Effects

Like all medications, Ozempic can have side effects. Some common ones include:

- Nausea

- Vomiting

- Diarrhea

- Stomach pain

In rare cases, it can cause more serious issues like pancreatitis. Always talk to your doctor about any side effects you experience.

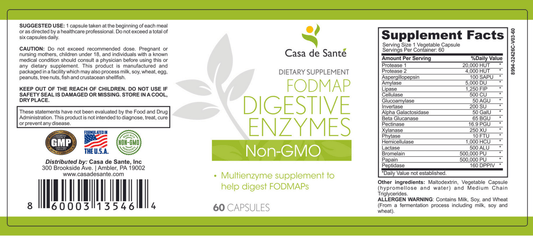

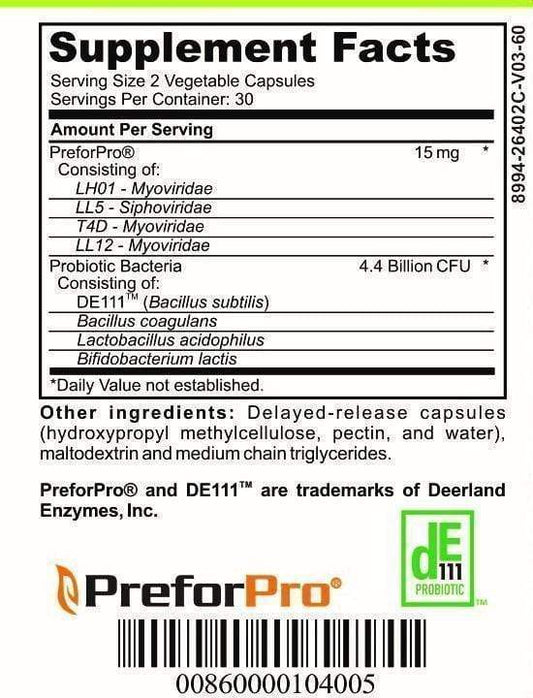

It's important to discuss all your medications, including over-the-counter ones like FODMAP digestive enzymes, with your healthcare provider to avoid any potential interactions.

Exploring Alternative Insurance Options

Switching to a Different Insurance Plan

If your current insurance doesn't cover Ozempic, consider switching to a different plan. Some insurance companies offer better coverage for weight loss medications. Research and compare plans to find one that suits your needs.

Utilizing Spouse or Family Member's Insurance

You might be able to use your spouse's or a family member's insurance plan. Check if their plan covers Ozempic and if you can be added as a dependent.

Government Programs like Medicare and Medicaid

Government programs such as Medicare and Medicaid may offer coverage for Ozempic. Eligibility and coverage can vary, so it's important to check the specific details of these programs.

Exploring these options can help you find a way to get the medication you need without breaking the bank.

Remember, while looking for insurance options, also consider other health products like low FODMAP collagen protein powder to support your overall well-being.

Financial Assistance Programs for Ozempic

Novo Nordisk’s Patient Assistance Program

Novo Nordisk offers a Patient Assistance Program (PAP) for those who qualify based on income. This program provides free or low-cost Ozempic to individuals who meet certain criteria. If you don't have insurance, this program might be a lifesaver. To apply, visit the Novo Nordisk website and fill out the necessary forms.

Discount Cards and Coupons

Discount cards and coupons can significantly reduce the cost of Ozempic. Websites like GoodRx, SingleCare, and drugs.com offer free coupons that you can present at your pharmacy. Here’s a quick look at potential savings:

| Supply Duration | Savings |

|---|---|

| 1-month | $150 |

| 2-month | $300 |

| 3-month | $450 |

Using FSAs and HSAs for Medication Costs

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) can also help cover the cost of Ozempic. You may need a letter of medical necessity from your healthcare provider to use these funds. Check with your account administrator to see if Ozempic is eligible.

Many people find that combining these financial assistance options can make Ozempic more affordable. Don't hesitate to explore all available resources to manage your medication costs.

Navigating Prior Authorization and Appeals

What is Prior Authorization?

Prior authorization is when your doctor needs to get approval from your insurance before you can get a certain medication. This process helps insurance companies decide if the treatment is necessary. Without this approval, your insurance might not pay for the medication.

Steps to Appeal a Denied Claim

If your insurance denies your claim, you can appeal. Here are the steps:

- Review the Denial Letter: Understand why your claim was denied.

- Gather Information: Collect all necessary documents, including your doctor's notes and any denial letters.

- Write an Appeal Letter: Explain why you need the medication and include any supporting documents.

- Submit the Appeal: Send your appeal to the insurance company and keep copies for yourself.

- Follow Up: Check the status of your appeal regularly.

Tips for Getting Approval

- Talk to Your Doctor: Your doctor can provide a letter explaining why you need the medication.

- Show Medical Necessity: Document why the medication is essential for your health.

- Use the Right Codes: Ensure your doctor uses the correct medical codes when submitting the request.

- Be Persistent: Sometimes, it takes multiple tries to get approval.

Remember, your doctor might have samples of the medication or know which pharmacies accept discount cards. Always ask for help if you need it.

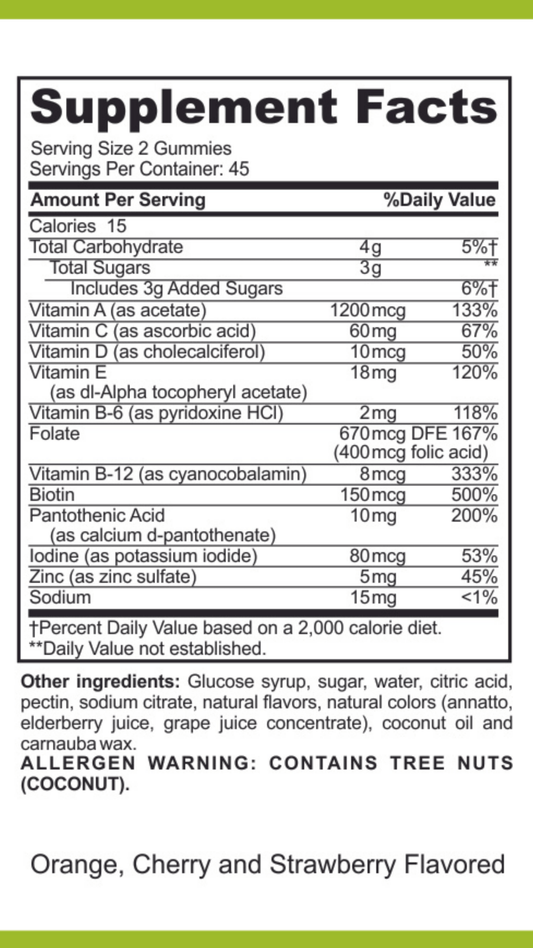

Navigating prior authorization and appeals can be challenging, but with the right steps, you can improve your chances of getting the medication you need. Don't forget to take your multivitamin and stay healthy!

Cost-Saving Strategies Without Insurance

Using Online Coupons and Discount Cards

One of the easiest ways to save on Ozempic is by using online coupons and discount cards. Websites like GoodRx and SingleCare offer discounts that can significantly lower the cost. These discounts can sometimes reduce the price by up to 80%. Always check multiple sites to find the best deal.

Exploring Generic Alternatives

While Ozempic itself doesn't have a generic version yet, there are other medications for diabetes that might be more affordable. Talk to your doctor about possible alternatives that could work for you.

Finding Affordable Pharmacies

Prices for medications can vary widely between pharmacies. Use online tools to compare prices at different pharmacies in your area. Sometimes, smaller, independent pharmacies offer better deals than big chains. Additionally, some pharmacies may accept discount cards that others do not.

Remember, stretching your medication by using less than the prescribed dose is not a safe way to save money. Always follow your doctor's instructions.

By combining these strategies, you can make your medication more affordable. Don't forget to also look into low FODMAP chocolate whey protein powder as a dietary supplement to support your health journey.

Understanding the Costs of Ozempic

Cost with Insurance

If your insurance covers Ozempic, your out-of-pocket costs will depend on your plan's drug copay. Copay amounts vary based on the formulary and tier assigned by your insurance company. Typically, Ozempic is placed in a higher tier due to its retail price of over $1,000 per month. This means you might pay between $200 and $300 monthly, but some plans could have copays as low as $10.

Cost without Insurance

Without insurance, the cost of Ozempic can be quite high. The retail price is around $1,029 per month. However, you can find lower prices by using discount websites like GoodRx, SingleCareRx, and Optum Perks. These sites offer coupons and discount cards that can help reduce the cost.

Impact of Deductibles and Copays

Your deductible and copay amounts can significantly affect your overall cost for Ozempic. If you haven't met your deductible, you might pay around $786 per month after discounts. Once your deductible is met, your costs will decrease. Additionally, using a Savings Card from Novo Nordisk can help lower your copay, with potential savings of up to $150 per month.

It's important to explore all available options to manage the cost of Ozempic, especially if your insurance doesn't cover it. Utilizing discount cards, exploring government programs, and discussing financial assistance with your healthcare provider can make a big difference.

Tips for Discussing Ozempic with Your Healthcare Provider

Preparing for Your Appointment

Before your appointment, gather all your medical records and a list of medications you are currently taking, including supplements like inositol. Being well-prepared can help your doctor understand your health needs better.

Questions to Ask Your Doctor

When you meet with your doctor, consider asking the following questions:

- What are the benefits and risks of taking Ozempic?

- How does Ozempic compare to other medications for my condition?

- Are there any lifestyle changes I should make while taking Ozempic?

- What should I do if I experience side effects?

- Is Ozempic covered by my insurance, or are there alternative options?

Documenting Medical Necessity

If your insurance requires prior authorization for Ozempic, your doctor will need to document why it is medically necessary for you. This may include:

- Your medical history and diagnosis

- Previous treatments and their outcomes

- Why Ozempic is the best option for you

Tip: Keep a personal health journal to track your symptoms and any side effects. This can be very helpful for your doctor when making a case for medical necessity.

Talking to your doctor about Ozempic can feel overwhelming, but it doesn't have to be. Start by writing down your questions and concerns. Be honest about your health goals and any side effects you’re worried about. For more tips and support, visit our website and explore our resources.

Conclusion

Getting Ozempic without insurance coverage can be tough, but it's not impossible. By exploring different options like manufacturer discounts, patient assistance programs, and alternative insurance plans, you can find ways to make this medication more affordable. Remember, it's important to talk to your doctor and insurance provider to understand all your options. With a bit of effort and research, you can manage the costs and get the treatment you need.

Frequently Asked Questions

What is Ozempic used for?

Ozempic is a medication primarily used to help manage type 2 diabetes. It helps control blood sugar levels and can also aid in weight loss.

Can I get Ozempic if my insurance doesn't cover it?

Yes, you can still get Ozempic even if your insurance doesn't cover it. There are several options like financial assistance programs, discount cards, and coupons to help reduce the cost.

What are the common side effects of Ozempic?

Some common side effects of Ozempic include nausea, vomiting, diarrhea, and stomach pain. Always consult your doctor if you experience any severe side effects.

How can I get financial help for Ozempic?

You can seek financial help through Novo Nordisk’s Patient Assistance Program, discount cards, and coupons. Additionally, using FSAs and HSAs can help cover medication costs.

What is prior authorization, and why do I need it for Ozempic?

Prior authorization is a process where your doctor needs to get approval from your insurance company before the medication is covered. This is often required for expensive drugs like Ozempic to ensure it's medically necessary.

Are there any generic alternatives to Ozempic?

Currently, there are no generic alternatives to Ozempic. However, your doctor might suggest other medications that can help manage your condition.