Have you ever wondered why your insurance won't cover Ozempic? It can be frustrating to need a medication and find out that your insurance won't help pay for it. There are several reasons why this might happen, and understanding them can help you find a solution.

Key Takeaways

- Ozempic is often covered for diabetes but not for weight loss.

- Insurance companies may require you to try cheaper medications first.

- Prior authorization is usually needed to get Ozempic covered.

- You can appeal an insurance denial for Ozempic.

- Prescription discount programs can help lower the cost if insurance doesn't cover Ozempic.

Understanding Insurance Coverage for Ozempic

What is Ozempic?

Ozempic is a medication known by its generic name, semaglutide. It is a once-a-week injection that helps lower blood sugar levels. Doctors mainly prescribe it for type 2 diabetes, but it can also aid in weight management.

FDA Approval and Off-Label Use

The FDA has approved Ozempic specifically for treating type 2 diabetes. Using it for other purposes, like weight loss, is considered off-label. Insurance companies often won't cover off-label uses.

Common Insurance Requirements

To get Ozempic covered by insurance, you usually need to meet certain requirements:

- Prior Authorization: Your doctor must fill out extra paperwork to show you need the medication.

- Step Therapy: Some plans require you to try cheaper drugs first, like metformin, before covering Ozempic.

- Employer-Based Coverage: Your job's insurance plan might limit or exclude coverage for Ozempic.

Even if Ozempic is on your insurance plan's list of covered drugs, you might still have to pay out-of-pocket costs like copays or deductibles.

If you're looking for a low FODMAP option, consider trying low FODMAP chocolate whey protein powder as part of your diet.

Factors Influencing Insurance Denial for Ozempic

Off-Label Prescription Issues

Insurance companies often deny coverage for Ozempic if it's prescribed for uses not approved by the FDA. Ozempic is FDA-approved for treating type 2 diabetes, but not for weight loss. If your doctor prescribes it for weight loss, your insurance might not cover it.

Step Therapy Requirements

Some insurance plans require you to try cheaper medications before they cover Ozempic. This is known as step therapy. For example, you might need to try metformin or psyllium before getting approval for Ozempic.

Employer-Based Coverage Limitations

Your job's insurance plan might have specific rules about covering Ozempic. Employers can choose to limit or exclude coverage for certain medications to save costs. This means your plan might not cover Ozempic at all, or only for a limited time.

Even if Ozempic is on your insurance plan's list of covered drugs, you might still have to pay some out-of-pocket costs. This can include deductibles, copays, or coinsurance.

Navigating Prior Authorization for Ozempic

What is Prior Authorization?

Prior authorization is a process where your doctor needs to get approval from your insurance company before you can get a medication like Ozempic. This step ensures that the drug is necessary for your health condition. Without this approval, your insurance might not cover the cost.

Steps to Obtain Prior Authorization

- Consult Your Doctor: Discuss with your doctor why you need Ozempic and ensure they support your request.

- Submit Paperwork: Your doctor will fill out and send the necessary forms to your insurance company, explaining why Ozempic is needed for your treatment.

- Wait for Approval: The insurance company reviews the request. This can take a few days to a few weeks.

- Receive Notification: You will be informed if the request is approved or denied. If denied, you can appeal the decision.

Common Challenges and Solutions

- Delayed Responses: Sometimes, insurance companies take longer to respond. Follow up regularly to check the status.

- Denials: If your request is denied, ask your doctor to provide more detailed information or consider alternative treatments.

- Paperwork Issues: Ensure all forms are filled out correctly and completely to avoid delays.

Navigating prior authorization can be tricky, but staying informed and proactive can make the process smoother. If you face challenges, don't hesitate to seek help from your healthcare provider or insurance company.

Remember, while dealing with insurance, you might also explore other supportive options like low FODMAP collagen protein powder to manage your health better.

Alternative Options if Insurance Doesn't Cover Ozempic

Appealing an Insurance Denial

If your insurance denies coverage for Ozempic, you can file an appeal. This involves your doctor providing evidence that other medications are not as effective or cause side effects. Appealing can sometimes change the decision.

Exploring Other Insurance Plans

Switching to a different insurance plan might help. You can look into:

- Health insurance through a spouse or family member.

- Government programs like Medicare or Medicaid.

- Private health insurance from HealthCare.gov or your state marketplace.

Using Prescription Discount Programs

Prescription discount programs can save you money. For example, the Optum Perks Discount Card can help you save up to 80% on some medications. Manufacturer coupons and savings cards for Ozempic are also available.

If your insurance doesn't cover Ozempic, don't lose hope. There are several ways to make the medication more affordable.

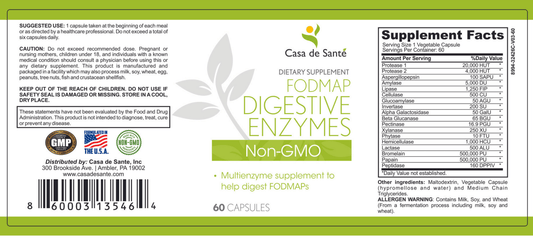

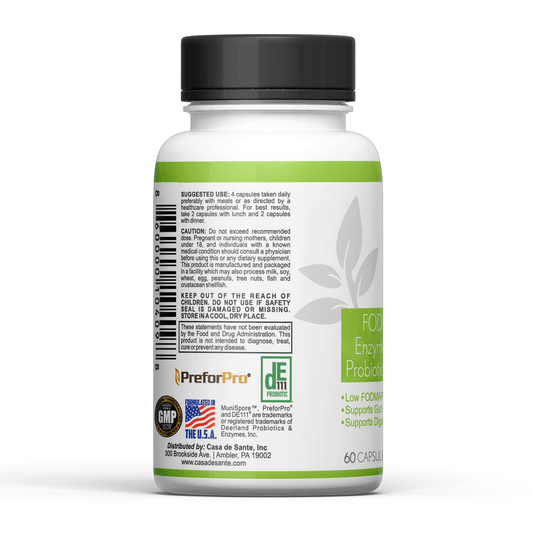

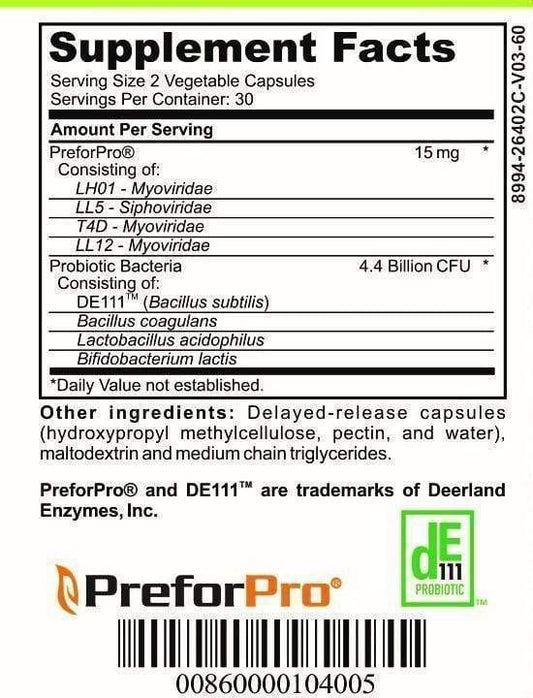

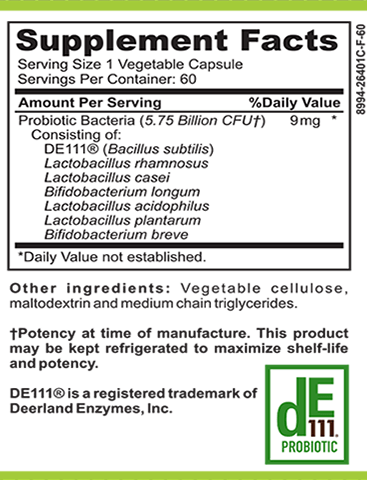

Additionally, consider looking into FODMAP digestive enzymes as a supplementary option for managing your health.

Cost Implications of Ozempic Without Insurance

Out-of-Pocket Costs

If you don't have insurance, Ozempic can be very expensive. The full price is around $936 per month, which adds up to $11,229 per year. This can be a big burden for many people.

Manufacturer Coupons and Savings Cards

NovoCare, the maker of Ozempic, offers discount programs that can help. If you qualify, you might pay as little as $0 or $131 per month. These savings can make a huge difference.

Comparing Costs with Other Medications

When looking at other medications, Ozempic is often more expensive. For example, generic drugs like inositol can be much cheaper. However, it's important to talk to your doctor about what medication is best for you.

Without insurance, the cost of Ozempic can be overwhelming, but there are programs that can help lower the price.

How to Check Your Insurance Plan’s Coverage for Ozempic

Reviewing Your Plan’s Formulary

To find out if your insurance covers Ozempic, start by checking your plan’s formulary. This is a list of medications that your insurance will pay for. You can usually find it on your insurance company’s website or in the paperwork they sent you when you signed up.

Contacting Your Insurance Provider

If you can’t find the formulary or if it’s hard to understand, call your insurance company. Use the number on your insurance card and ask if Ozempic is covered. Make sure to ask if you need prior authorization or if there are any special rules.

Understanding Your Plan’s Summary of Benefits

Look at your plan’s Summary of Benefits and Coverage (SBC). This document explains what your plan covers and how much you’ll have to pay. You can get a copy from your insurance company or find it online through your healthcare marketplace account.

Checking your insurance coverage for Ozempic can save you from unexpected costs and help you understand your options better.

Remember, some insurance plans might have specific requirements like trying other medications first or needing a doctor’s note to show that Ozempic is necessary. Always double-check to avoid surprises.

Wondering if your insurance covers Ozempic? It's easy to find out! Just visit our website and follow the simple steps to check your coverage. Don't miss out on the chance to transform your health with our GLP-1 weight loss clinic.

Conclusion

Navigating the world of insurance coverage for Ozempic can be tricky. While it is often covered for type 2 diabetes, getting it approved for weight loss is much harder. Insurance companies have strict rules and may require you to try other treatments first. If you face a denial, don't give up. You can appeal the decision or explore other insurance options. Understanding your plan and knowing your rights can help you get the medication you need. Stay informed and proactive in your healthcare journey.

Frequently Asked Questions

What is Ozempic used for?

Ozempic is a medication mainly used to treat type 2 diabetes. It helps control blood sugar levels and can also aid in weight loss.

Why won’t my insurance cover Ozempic?

Insurance may not cover Ozempic if it's prescribed for weight loss instead of diabetes, or if you haven’t tried less expensive medications first.

What can I do if my insurance denies coverage for Ozempic?

You can appeal the decision, try switching insurance plans, or use prescription discount programs to lower the cost.

What is prior authorization?

Prior authorization is a process where your doctor must get approval from your insurance company before the prescription is covered.

Are there cheaper alternatives to Ozempic?

Yes, some insurance plans require you to try less expensive medications like metformin before covering Ozempic.

How can I find out if my insurance covers Ozempic?

You can check your plan’s formulary, contact your insurance provider, or review your plan’s summary of benefits.