Ozempic is a medication that has been making waves for its effectiveness in treating type 2 diabetes and aiding in weight loss. For many, getting a prescription online can be a convenient option, especially when combined with insurance coverage. This guide will walk you through everything you need to know about obtaining Ozempic online with insurance, from understanding the medication to maximizing your benefits.

Key Takeaways

- Ozempic helps manage type 2 diabetes and can assist with weight loss.

- You can get an Ozempic prescription online through telehealth services.

- Most insurance plans cover Ozempic for diabetes, but coverage for weight loss varies.

- Using FSAs and HSAs can help manage out-of-pocket costs for Ozempic.

- Discount cards and patient assistance programs can reduce the cost of Ozempic.

Understanding Ozempic and Its Uses

What is Ozempic?

Ozempic is a medication with the active ingredient semaglutide. It belongs to a class of drugs known as glucagon-like peptide-1 (GLP-1) receptor agonists. Ozempic mimics the action of a natural hormone in the body that helps regulate blood sugar levels. It is typically administered as a once-weekly injection.

Medical Conditions Treated by Ozempic

Ozempic is primarily used to manage type 2 diabetes. It helps lower blood sugar levels and reduces the risk of heart attacks and strokes. While not officially approved for weight loss, some doctors prescribe it off-label for this purpose. However, it is not suitable for treating type 1 diabetes.

How Ozempic Works in the Body

Ozempic works in several ways:

- Stomach: Slows down the emptying of food, making you feel full longer.

- Pancreas: Stimulates the release of insulin when blood sugar levels are high.

- Brain: Sends signals to reduce hunger and food cravings.

Combining Ozempic with lifestyle changes like a balanced diet and regular exercise, including fiber-rich foods like psyllium, can enhance its effectiveness.

How to Get an Ozempic Prescription Online

Steps to Obtain an Online Prescription

- Sign Up: Start by creating an account on a telehealth platform that offers Ozempic prescriptions.

- Book a Consultation: Schedule a virtual appointment with a licensed healthcare provider.

- Medical Review: During the consultation, discuss your medical history and health goals. The provider may ask for lab tests.

- Receive Prescription: If deemed appropriate, the provider will send an electronic prescription to your chosen pharmacy.

- Follow-Up: Regular follow-up appointments may be required to monitor your progress.

Choosing a Reliable Telehealth Provider

When selecting a telehealth provider, consider the following:

- Licensing: Ensure the platform employs licensed healthcare professionals.

- Reviews: Check user reviews and ratings.

- Services Offered: Confirm that they provide Ozempic prescriptions and support for diabetes management.

- Payment Options: Look for providers that accept insurance, HSAs, or FSAs.

Consultation Process and Requirements

The consultation process typically involves:

- Initial Assessment: A review of your medical history and current health status.

- Discussion: Talk about your health goals, such as weight loss or diabetes management.

- Lab Tests: You may need to complete lab tests to ensure Ozempic is safe for you.

- Prescription: If approved, the provider will send the prescription to your pharmacy.

Tip: Using a low FODMAP collagen protein powder can complement your health regimen while taking Ozempic.

Insurance Coverage for Ozempic

Types of Insurance Plans That Cover Ozempic

Insurance coverage for Ozempic can vary widely. Most insurance plans cover Ozempic for treating type 2 diabetes. However, coverage for weight loss or other conditions might be limited. Here are some common types of insurance plans that may cover Ozempic:

- Employer-Sponsored Plans: Often provide coverage for diabetes management, including Ozempic.

- Medicare Part D: Covers Ozempic for diabetes but not for weight loss.

- Medicaid: Coverage can vary by state, but it generally includes diabetes medications.

- Private Insurance: Coverage depends on the specific plan and insurer.

Navigating Prior Authorization

Before your insurance covers Ozempic, you might need prior authorization. This means your doctor must prove that the medication is medically necessary. Here are the steps to navigate prior authorization:

- Consult Your Doctor: Discuss why Ozempic is needed for your treatment.

- Submit Paperwork: Your doctor will send the required forms to your insurance company.

- Wait for Approval: This can take a few days to a few weeks.

- Appeal if Denied: If your request is denied, you can appeal the decision.

Using FSAs and HSAs for Ozempic

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) can help cover the cost of Ozempic. These accounts let you use pre-tax dollars for medical expenses, including prescriptions. Here’s how you can use them:

- Check Eligibility: Ensure Ozempic is an eligible expense under your FSA or HSA plan.

- Save Receipts: Keep all receipts for Ozempic purchases to submit for reimbursement.

- Submit Claims: Follow your plan’s process to get reimbursed for your out-of-pocket costs.

Using FSAs and HSAs can significantly reduce your out-of-pocket expenses for medications like Ozempic.

Understanding your insurance coverage and knowing how to navigate the system can make getting your Ozempic prescription easier and more affordable.

Cost of Ozempic with Insurance

Average Monthly Costs with Insurance

The cost of Ozempic with insurance can vary widely. On average, it ranges between $200 and $300 per month. However, some insurance plans may offer copays as low as $10. Your exact cost will depend on your specific insurance plan and its formulary.

Factors Affecting Out-of-Pocket Costs

Several factors can influence your out-of-pocket costs for Ozempic:

- Insurance Plan: Different plans have different copays and coverage levels.

- Formulary Tier: Ozempic is often placed in a higher tier, which can mean higher copays.

- Prior Authorization: Some plans require prior authorization, which can delay access and affect costs.

- Discount Cards and Coupons: Using discount cards from websites like GoodRx or SingleCare can lower your costs.

Using Discount Cards and Coupons

Discount cards and coupons can be a great way to save on Ozempic. Websites like GoodRx, SingleCare, and Optum Perks offer free coupons that you can present at your pharmacy. Some pharmacies are already linked with these services, so you might not even need to print a coupon.

| Supply Duration | Average Cost with Insurance |

|---|---|

| 1-month | $150 - $300 |

| 2-month | $300 - $450 |

| 3-month | $450 - $600 |

If your copay for Ozempic is $300 for a one-month supply, using a discount card could save you up to $150, making your final cost $150.

Using FSAs and HSAs for Ozempic

If you have a Flexible Spending Account (FSA) or Health Savings Account (HSA), you might be able to use it to cover the cost of Ozempic. You may need a letter of medical necessity from your healthcare provider to submit to your account's administrator.

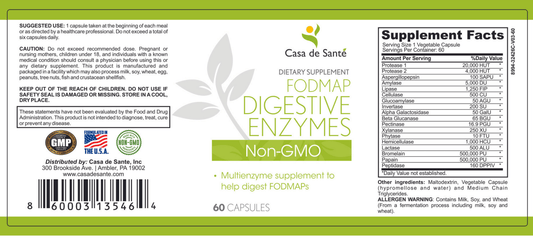

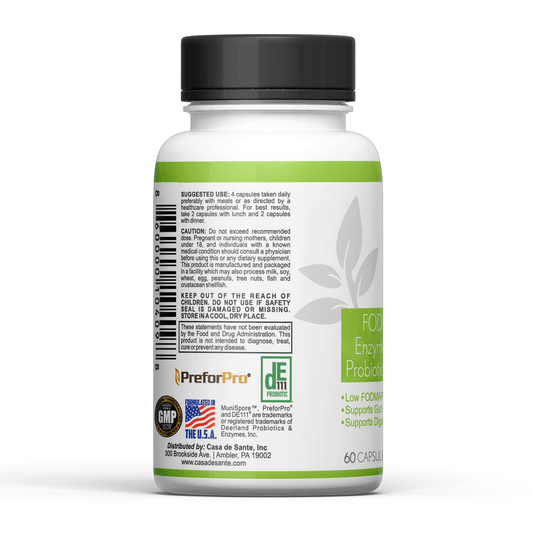

Tip: Always check with your insurance provider and pharmacy to explore all available options for reducing your out-of-pocket costs. Including FODMAP digestive enzymes in your diet can also help manage digestive issues while on Ozempic.

Managing Ozempic Without Insurance

Retail Price of Ozempic

Without insurance, the retail price of Ozempic can be quite high. The average cost is around $1,029 per month. Prices can vary depending on the pharmacy you choose. Websites like SingleCareRx, Optum Perks, and NeedyMeds can help you find the lowest prices in your area. These sites also offer coupons and discount cards that you can use at your pharmacy.

Alternative Payment Options

If you don't have insurance, there are still ways to manage the cost of Ozempic:

- Discount Cards and Coupons: Websites like GoodRx, SingleCareRx, and drugs.com offer free coupons that can lower the price. Some pharmacies are already linked with these sites, so you might not even need to print a coupon.

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): If you have an FSA or HSA, you might be able to use it to cover the cost of Ozempic. You may need a letter of medical necessity from your healthcare provider.

- Medicare Help Programs: If you qualify for Medicare and have limited income, you might be eligible for the Medicare Part D Extra Help Program. This program can help cover deductibles and copays for prescription drugs, including Ozempic.

Patient Assistance Programs

Novo Nordisk, the manufacturer of Ozempic, offers a Patient Assistance Program for those who qualify. This program can provide Ozempic at a reduced cost or even for free. To qualify, you'll need to meet certain income and insurance criteria. You can apply online or through your healthcare provider.

Managing the cost of Ozempic without insurance can be challenging, but there are several options available to help reduce the financial burden. From discount cards to patient assistance programs, you have multiple avenues to explore.

Tips for Maximizing Insurance Benefits

Understanding Your Insurance Plan

To get the most out of your insurance, you need to understand your plan. Know what your plan covers and what it doesn't. Check if Ozempic is on your insurance's formulary list and what tier it falls under. This will help you estimate your out-of-pocket costs.

Communicating with Your Provider

Talk to your healthcare provider about your insurance coverage. They can help you with the paperwork and provide the necessary documentation for prior authorization. Clear communication can prevent delays and denials.

Appealing Insurance Denials

If your insurance denies coverage for Ozempic, don't give up. You have the right to appeal. Work with your healthcare provider to gather all necessary documents and submit an appeal. Persistence can pay off.

Remember, understanding your insurance plan and communicating effectively with your provider are key steps in maximizing your benefits. Don't hesitate to ask questions and seek help when needed.

Safety and Efficacy of Ozempic

Potential Side Effects

Ozempic, like any medication, can have side effects. The most common ones are related to the digestive system, such as nausea, vomiting, and stomach pain. Diarrhea and constipation can also occur. It's important to monitor these symptoms and consult your doctor if they become severe. Rarely, some people may experience a bowel obstruction called ileus.

Monitoring and Follow-Up Care

Regular check-ups with your healthcare provider are crucial when taking Ozempic. Typically, you should have a follow-up appointment one month after starting the medication and then every three to twelve months. These visits help ensure the medication is working effectively and allows for adjustments if needed.

Long-Term Benefits and Risks

Ozempic has shown significant benefits in managing type 2 diabetes and aiding in weight loss. However, long-term use requires careful monitoring to manage any potential risks. Always discuss the long-term plan with your healthcare provider.

Regular follow-ups and open communication with your healthcare provider can help you manage the benefits and risks of Ozempic effectively.

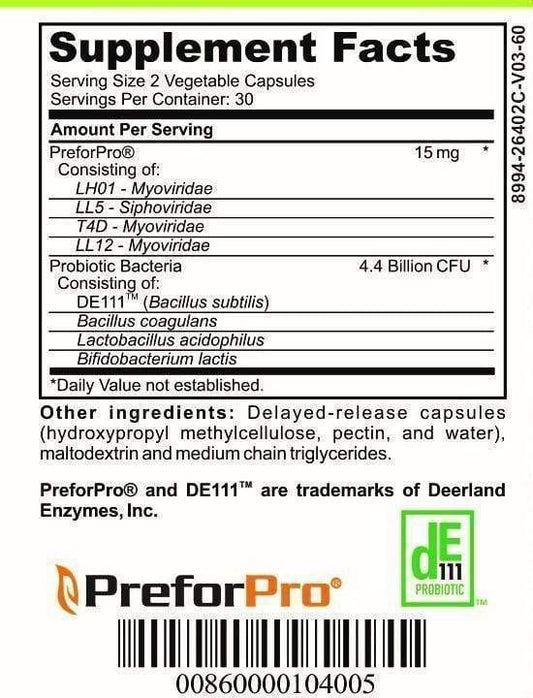

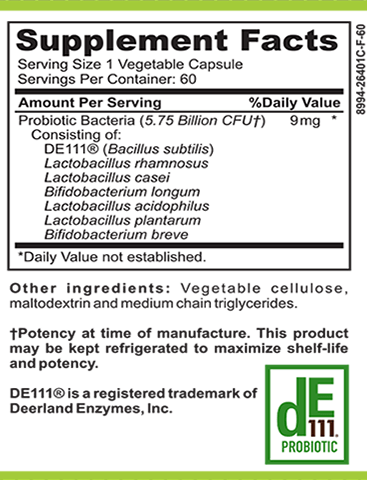

For those looking to support their digestive health while on Ozempic, incorporating a low FODMAP probiotic can be beneficial.

Ozempic is a medication that helps with weight loss and managing blood sugar levels. It's important to know if it's safe and works well. Our website has all the details you need. We also offer a special clinic for weight loss using Ozempic. Visit us to learn more and start your journey to better health today!

Conclusion

Getting an Ozempic prescription online with insurance can be a convenient and effective way to manage your health. By understanding the steps involved, from consulting with a healthcare provider to navigating insurance coverage, you can make informed decisions about your treatment. Remember, it's important to follow medical advice and maintain a healthy lifestyle to achieve the best results. With the right approach, Ozempic can be a valuable tool in your journey towards better health.

Frequently Asked Questions

What is Ozempic used for?

Ozempic is a medication primarily used to manage type 2 diabetes. It helps control blood sugar levels and can also reduce the risk of heart problems. Some people also use it for weight loss.

How can I get an Ozempic prescription online?

To get an Ozempic prescription online, you need to sign up with a telehealth provider, have a consultation with a healthcare professional, and if deemed suitable, they will prescribe it for you.

Does insurance cover the cost of Ozempic?

Many insurance plans cover Ozempic, especially for type 2 diabetes treatment. However, coverage for weight loss might be limited. It's best to check with your insurance provider.

What are the possible side effects of Ozempic?

Common side effects of Ozempic include nausea, vomiting, diarrhea, and stomach pain. It's important to talk to your doctor about any side effects you experience.

Can I use a Health Savings Account (HSA) or Flexible Spending Account (FSA) to pay for Ozempic?

Yes, you can use HSA or FSA funds to pay for Ozempic. You might need a letter of medical necessity from your healthcare provider.

How much does Ozempic cost without insurance?

Without insurance, the cost of Ozempic can be quite high, averaging around $1,000 per month. Discounts and coupons can help lower the price.